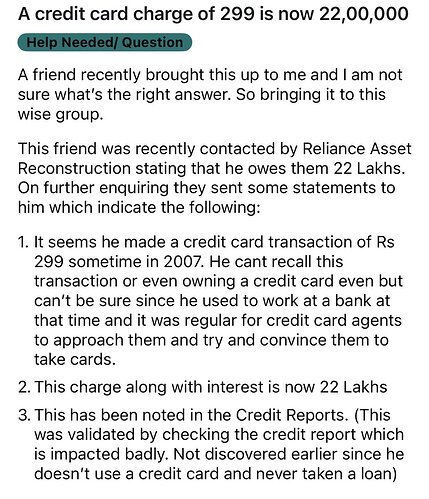

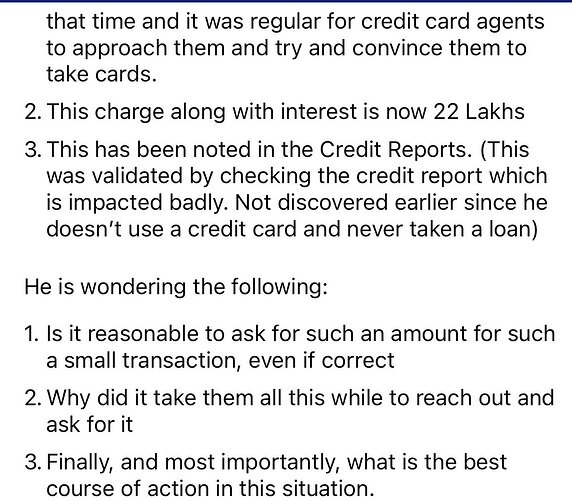

Does it seem real? A person missed a credit card payment of 299 in 2007 and it compounded to 22 lakhs!!

I am not sure if this is real but certainly a good lesson for all the credit card users. The bills do get compounded if left unpaid be it the finance charges or the penalties. And worst of all, there will be a long term impact on the credit score if there is a settlement on this account now.

Posting from one of the linkedin accounts as I found this post relatable…

A payment of Rs 299 through credit card ended up becoming a liability of Rs 22 lakhs…

An Indian man received a demand notice of Rs 22 lakhs from the recovery agents for unpaid credit card debt…

When he enquired about the same in detail, he was told there was an amount of Rs 299 charged on his credit card in 2007… which remained unpaid over the years… and has now cumulated to over Rs 22 lakhs…

Here, the compounding on the card is definitely over 45%… and the calculation may include things like late fees, and more…

And while the man will contest it in court or with the RBI Ombudsman… there’s a bigger learning here…

The number of young people I see getting credit cards to avail points and discounts on items… to me mostly sounds penny wise and pound foolish.

The business of credit card companies is profitable despite such offers and discounts is because a huge set of people forget or don’t pay their bills on time and the interest cost is obnoxiously high…

A number of times banks issue cards to you to meet targets, or it’s become such a fad to collect cards - something for travel points, another for golf access, and a third for utility payments…

That I mostly recommend the following:

1/ Do not hold more than 2 credit cards no matter how exciting it sounds to have more

2/ Always pay a small amount over and above the bill amount, maybe just Rs 5 more… because most mistakes happen when people end up paying a whole number that is slightly smaller than the actual amount due

3/ A better use of your time is to actually build skill, and work towards earning active income better rather than constantly wasting time on calculating points across cards for discounts.

It’s a good tool, but is being over used and over optimized leading to financial indiscipline from a psychological pov.