How does an Account Aggregator notify users about consent expiry? What does the SMS reminder look like, and how can I take action to renew it?

Account Aggregators in India require users to provide consent for sharing financial data with institutions. This consent is time-bound and must be renewed periodically. To help users avoid interruptions in services, most Account Aggregators send SMS reminders before consent expiry. Understanding the format and content of these reminders helps users respond promptly and ensure seamless data-sharing.

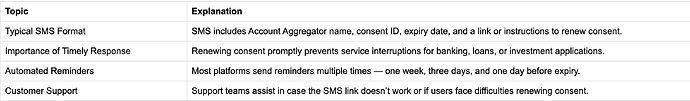

Typical Account Aggregator Consent Expiry SMS Format for Account Aggregator

I received a consent expiry reminder from my Account Aggregator, which contained the platform name, consent ID, expiry date, and a direct link or instructions to renew the consent. A typical message read: Your consent with [Account Aggregator Name] (Consent ID: 12345) for sharing financial data will expire on 30-Aug-2025. Please renew to continue uninterrupted access: [link].

Importance of Timely Response to SMS Reminder for Account Aggregator

A friend of mine ignored the SMS for a few days and realized that his financial application was temporarily paused due to expired consent. Once he renewed using the link provided, services resumed immediately. This shows that timely action on SMS reminders prevents disruptions in banking and investment services.

Automated SMS Reminders and Frequency for Account Aggregator

On a finance forum, I read that some Account Aggregators send multiple reminders — typically one week, three days, and one day before consent expiry. This ensures users have enough notice to renew their consent without missing any deadlines.

Customer Support for Consent Renewal for Account Aggregator

A colleague mentioned that when he faced issues with the SMS link, he contacted the Account Aggregator’s customer support. They guided him through the renewal process and confirmed the updated consent status.

What are the legal requirements for Account Aggregator consent expiry SMS reminders in India?

Understanding digital consent becomes crucial as regulatory requirements increase. Apps must regularly request permission renewals, but users often can’t distinguish real notifications from fraudulent ones. Learning to identify authentic communication patterns helps protect both personal data and access to essential financial services.

What Even Is This:

You know how there are apps now that show you all your bank accounts in one place. Well, those apps need your permission to snoop around your accounts. And that permission has an expiration date, like milk.

How I Screwed This Up:

-

I’ve been using this app for ages to track my spending and see all my accounts together. Super handy when you’re trying to figure out if you can afford that new phone or whatever.

-

I’m thinking, what consent. I never signed anything fancy. Must be some marketing thing trying to get me to buy premium features.

-

Last week I’m trying to check my account balance before buying lunch, and the app shows nothing. Like completely empty. I’m standing there thinking someone stole all my money or the app got hacked.

-

Nope. Turns out when you ignore those “consent expiring” messages, the app literally loses permission to see your bank accounts. It’s like your mom changing the WiFi password after you ignored her texts about taking out the trash.

Had to spend my lunch break figuring out how to fix it instead of eating. That’s when I learned this whole thing is actually backed by government rules:

- Companies need your permission before they can text you about this stuff

- The messages can’t be written in lawyer speak they have to make sense

- They warn you multiple times before cutting off access

- Only verified companies can send these, not random scammers

Why This Actually Helps:

- No sneaky business: You always know who’s looking at your money

- Fair warning: They can’t just randomly cut you off without telling you

- Normal language: No confusing legal jargon that nobody understands

- Your choice: Want them to stop texting? You can make that happen

- Less scams: Rules make it harder for fake companies to trick people

What These Messages Have to Include: The government is pretty specific about what needs to be in these texts:

- Your name and phone number (so you know it’s really meant for you)

- Some ID number to track your specific permission

- Exactly when your permission runs out

- What they’re actually doing with your account info

- Which bank or company gets access

- Link to their actual website to renew

- Way to stop getting these messages if you want

Here’s the Deal:

I thought I was being clever by ignoring them, but I just made my life harder. Now when I get these reminders, I literally just click the link and hit renew. Takes like 20 seconds and my apps keep working.

Getting weird messages and can’t tell if they’re legit. Just tell me which app it’s from and what it says I’ll help you figure out if it’s real or someone trying to mess with you!

Chirag think of it like this, your Account Aggregator consent is basically a hall pass. It lets the app peek into your bank accounts, but it expires after a while. That’s why you get those reminder texts. They’re not spam (well, if they’re from the right source) — they’re actually required by law to warn you in plain language before your access gets cut off.