I recently heard about cases of AA consent fraud, where someone might misuse the consent flow to access financial data. How can I detect if such fraud happens and make sure my data stays safe?

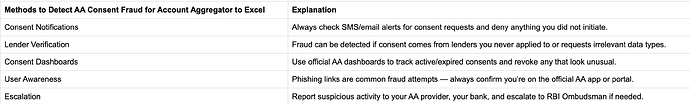

The Account Aggregator (AA) framework in India is designed with RBI guidelines and a consent-driven architecture. Still, just like with any digital financial system, there is always a risk of fraud attempts — especially if someone tricks a user into giving consent unknowingly. Detecting consent fraud early is crucial to protecting sensitive financial data. Based on different real-world experiences, here are some ways users have identified and handled suspicious activities.

Checking consent notifications carefully for Account Aggregator to Excel:

From my own experience, I make it a habit to check the SMS and email notifications I receive whenever consent is generated. Once, I saw a request that I hadn’t initiated, and because I immediately denied it, no data was shared. These alerts are the first line of defence.

Watching for mismatched lender requests for Account Aggregator to Excel:

A friend of mine noticed that an NBFC he never applied to had raised a consent request. He figured it out because the request came with unusual data types, like GST information, which he never needed to share. Spotting mismatches between the lender’s name and your actual application is a quick way to detect fraud.

Using consent dashboards to track history for Account Aggregator to Excel:

My colleague shared that his bank’s AA app had a consent dashboard where every active and expired consent was listed. When he checked, he found a request that was active longer than the stated period. By revoking it immediately, he prevented further data access. Monitoring dashboards regularly helps catch suspicious activity.

Community discussions on early fraud detection for Account Aggregator to Excel:

I read on a finance forum where several users mentioned that consent fraud often starts with phishing links. Fraudsters send fake AA-like portals to trick users into approving. Forum members suggested always verifying the official AA partner app or website before entering credentials.

When to escalate fraud cases for Account Aggregator to Excel:

After going through posts on Reddit, I found that if suspicious consent activity continues, the best step is to immediately escalate to the AA provider and also inform your bank. Some users even suggested filing a complaint with RBI’s Ombudsman if financial data was accessed without proper consent.