I heard about the AU Bank Xcite Ace Credit Card, it’s a cashback lifestyle credit card, designed to reward everyday retail, bill payments, fuel spends, and offer lounge access and device protection. How smooth is the online application process? What eligibility is required, and is a referral needed?

One of my friends just availed one of these cards and said that he had no problem getting an approval as his income and the credit score simply fell within the typical criteria of qualification. He particularly stated that no referral was necessary and the process was digital and easy to go through.

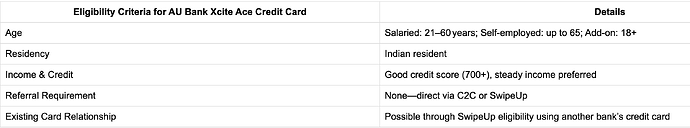

AU Bank Xcite Ace Credit Card Eligibility Criteria:

- Must be an Indian citizen and between the ages of 21-60 years

- should have a stable income

- The credit score around 700-750 or above is preferable.

- No invitation, no referral necessary

- History of income can be checked particularly in case of salaried applicants

How to Apply for the AU Bank Xcite Ace Credit Card Online:

- Go to AU bank credit card site

- Choose Xcite Ace Credit Card and press the Apply Now button

- Enter PAN, Aadhaar linked mobile number, employment and income

- Full video KYC (normally demanded)

- Apply online by submitting necessary papers and complete application process

Documents Required for AU Bank Xcite Ace Credit Card:

You may be required to submit:

- PAN Card

- Aadhaar Card (id and address proof)

- The two recent payslips

- Last 3 months Bank statement

- A digital upload of one passport size photograph.

Approval Process & Timeline for AU Bank Xcite Ace Credit Card:

Documental confirmations were done the next following day and the process of approval took a period of 2 working days

The Physical card took less than 6 days time after approval and the status of Application could be monitored on the web site on the basis of your mobile number or application ID