I am planning to get the Axis Bank Atlas Credit Card and want to know all the benefits, offers, and complimentary services it provides

I have read elsewhere (popular travel rewards forum) that the Axis Bank Bank Atlas credit card is made for frequent travelers looking flexibility on miles & tier benefits. Members taking part in the conversation claimed that the tiered system is a key feature because it elevates your benefits according to your annual spends. They also said that the conversion of options for Air Miles and hotel points enable it to be a versatile travel companion.

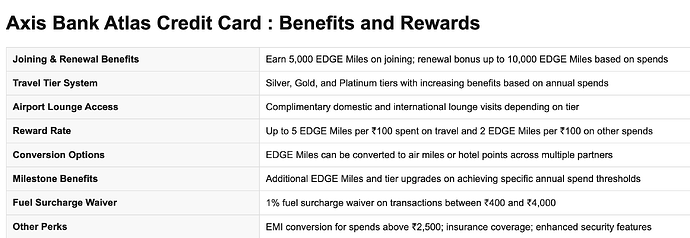

1. Membership & Renewal Offer for Axis Bank Atlas Credit Card

Joining benefits pay 5,000 EDGE Miles to the cardholders on card membership and up to 10,000 bonus EDGE Miles on renewal depending on yearly spends.

2. Travel Tier System for Axis Bank Atlas Credit Card

The system divides the travel tier into three tier Silver, Gold and Platinum wherein a higher level attracts better benefits with an increase in yearly spending.

3. Airport Lounge Access for Axis Bank Atlas Credit Card

The domestic and international benefits regarding use of a lounge are dependent on the current tier of the card holder.

4. Reward Rate for Axis Bank Atlas Credit Card

Get 5 EDGE Miles per 100 (spend 100) spent on travel and 2 EDGE Miles per 100 (spend 100) on other purchases.

5. Conversion Options for Axis Bank Atlas Credit Card

EDGE Miles may be transferred into air miles or hotel the loyalty points with various travel partners.

6. Milestone Benefits for Axis Bank Atlas Credit Card

The milestone rewards are additional EDGE Miles and a tier upgrade with achieving certain annual spending limit.

7. Waiver of Fuel Surcharge for Axis Bank Atlas Credit Card

When fuel is bought between 400 to 4000, the 1per cent of the surcharge is waived.

8. Other Perks for Axis Bank Atlas Credit Card

Other benefits involve the EMI options on purchases worth more than 2500 of the currency used, insurance cover, and EMV chip provision to increase the security.

I’m considering the Axis Bank Atlas Credit Card and would like to know what are the key benefits and rewards it offers, especially for someone who travels often and wants to maximize points on flights and hotels?

The Axis Bank Atlas Credit Card is a great option if you travel often, as it is built around travel-focused rewards and lifestyle perks. Here are the key benefits and rewards you can expect:

• EDGE Miles on Every Spend – You earn EDGE Miles for your transactions, which can be redeemed for flights, hotels, and other travel experiences across multiple airlines and platforms.

• Tier-based Rewards Program – The card offers a unique Silver, Gold, and Platinum tier system. As your annual spends increase, you move up tiers and unlock higher reward rates and bonus EDGE Miles.

• Airport Lounge Access – Complimentary domestic and international airport lounge visits make your travel more comfortable and premium.

• Milestone Benefits – On hitting specific spend milestones, you get additional EDGE Miles, giving you faster rewards accumulation.

• Global Travel Flexibility – Since EDGE Miles can be transferred to various frequent flyer and hotel loyalty programs, you get more freedom in planning your trips.

• Lifestyle Privileges – Apart from travel, you also enjoy Axis Bank’s dining delights and lifestyle offers, adding more value to everyday use.

So, if you’re someone who flies frequently and prefers redeemable travel rewards over generic cashback, the Axis Bank Atlas Credit Card can genuinely help you maximize your spends while giving you exclusive travel privileges.

Atlas is a great card just apply for it as it is going to be discontinued, just the eligibility criteria is very high for many to apply.