I am planning to get the Axis Bank Magnus Burgundy Credit Card and want to know all the benefits, offers, and complimentary services it provides

One of my friends has been using Axis Bank Magnus Burgundy Credit Card over a year and when we chat, he assures me that it is one of the best cards available in the market. His favorite thing about it is its balance between travel luxuries, high reward rates as well as exclusive privileges. Unlimited lounge access, abundant reward points, it is obvious that this card is aimed at individuals who desire to get ultimate benefits. This is what he told me of it.

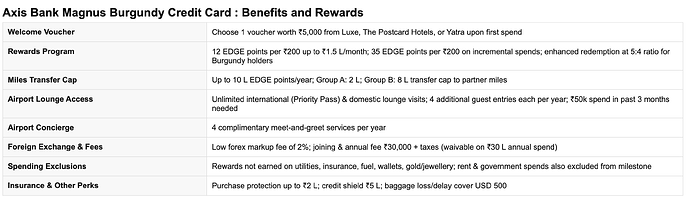

1. Activation Reward for Axis Bank Magnus Burgundy Credit Card

One of my friends got a voucher worth 5,000 rupees with The Postcard Hotels (Luxe), or Yatra after the initial contactless transaction, of 90 days after having gotten the card.

2. Rewards Program for Axis Bank Magnus Burgundy Credit Card

He can earn 12 EDGE Reward Points on the use of every 200 rupees up to a limit of 1.5 lakh a month but any purchase beyond that will attract 35 points per 200 rupees. He further has a superior redemption ratio of 5:4 since he is a Burgundy account holder.

3. Miles Transfer Cap for Axis Bank Magnus Burgundy Credit Card

He is able to transfer a maximum of 10 lakh EDGE points per year-where the maximum number he can transfer to the Group A partners should be 2 lakh points and to the Group B partners being 8 lakh points.

4. Airport Lounge Access for Axis Bank Magnus Burgundy Credit Card

He also has indefinite international lounge access through the Priority Pass along with additional and primary cardholders as well as unlimited domestic lounge visits. It has 4 free guest visits annually and many times, new users do not need to spend 50,000 in last 3 months.

5. Airport Concierge for Axis Bank Magnus Burgundy Credit Card

He also gets free meet and greet services in carefully selected airports, up to 4 times a year.

6. Foreign Exchange & Fee for Axis Bank Magnus Burgundy Credit Card

The markup rate is rather low at 2%, and the joining/annual fee is 30,000/- plus taxes but is not charged in case of an expenditure of 30Lakhs a year.

7. Spending Exclusions for Axis Bank Magnus Burgundy Credit Card

Does not earn reward on spend on utilities/ insurance / fuel / wallet dump / gold/ jewellery. Milestone expenditures are both rent and government free.

8. Insurance & Other Perks for Axis Bank Magnus Burgundy Credit Card

When it comes to the purchase protection up to 2 lakh in rupees, the air accident protection of 5 lakh in rupees as well as the baggage/delay cover of USD five hundred, this card provides the cardholders with all these protections.