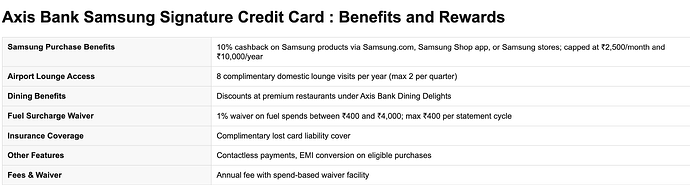

I am considering applying for the Axis Bank Samsung Signature Credit Card and want to know about the benefits, offers, and services that come with it.

I have had a friend getting the Axis Bank Samsung Signature Credit Card mostly for the Samsung cashback and a couple of travel benefits. After a couple of months, he claims it’s still been a good deal—in particular when he buys big Samsung purchases at the right time and claims the lounge visits on domestic trips. The caps is not something he hangs his hat on but overall he feels it balances out.

1. Samsung Customer Benefits for Axis Bank Samsung Signature Credit Card

He makes 10 percent cashback on Samsung purchases through Samsung.com, Samsung Shop app, or Samsung stores in India; he just pays attention to the limits 2,500 every month and 10,000 per card anniversary year, so that he does not transfer his large purchases to the next month.

2. Airport Lounge Access for Axis Bank Samsung Signature Credit Card

In the case of the airport lounges, he gets eight domestic visitations annually (two visits each quarter), and he utilizes that on early-mornings flights and on his stopovers, and he does not have grand amenities, but convenient in a momentary snack and Wi-Fi.

3. Dining Benefits for Axis Bank Samsung Signature Credit Card

He activates Axis Bank Dining Delights on the app when going out to eat at one of the premium partner restaurants and makes its booking through it to claim the additional offering of the discount.

4. Waiver on Fuel Surcharge for Axis Bank Samsung Signature Credit Card

Fuel is slightly cheaper as 1 percent surcharge is waived on 400-4000 transaction, limited to 400 per statement cycle- small, consistent savings.

5. Insurance Coverage for Axis Bank Samsung Signature Credit Card

The lost card liability cover provides the comfort he enjoys; he is happy when he knows that he will not entirely be at fault should the worst happen due to instances of misuse.

6. Other Features for Axis Bank Samsung Signature Credit Card

Tap-to-pay has worked to make small daily spends seamless and he has converted some of the bigger purchases into EMIs, to even out monthly budgets.

7. Fees & Charges for Axis Bank Samsung Signature Credit Card

Annual fee is there but he manages his spending so as to reach the waiver level of spending to make the card largely free since cash-back and perks cover the cost.