I’m looking for a safe LIC plan that will at least beat inflation over the next 15-20 years. Between the classic New Endowment Plan and the Bima Jyoti plan, which is a better choice for this goal?

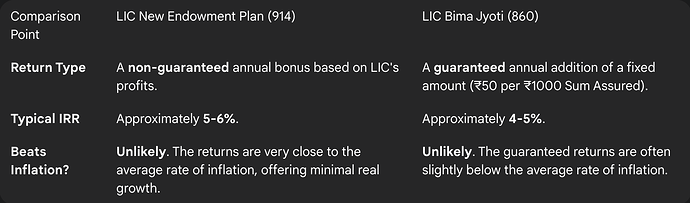

Neither the LIC New Endowment Plan nor the Bima Jyoti plan is likely to beat inflation in a significant way over the long term. Both are very safe savings instruments that provide returns typically close to or slightly below the average rate of inflation, meaning your money’s real growth will be minimal. They differ in how their returns are structured: one is variable, and the other is guaranteed.

The Variable, Bonus-Based Returns of the New Endowment Plan

I was discussing this with a financial advisor, and he explained that the New Endowment Plan is a ‘with-profit’ policy. Its returns are generated from non-guaranteed annual bonuses that LIC declares based on its profits. He pointed out that historically, the final Internal Rate of Return (IRR) on such plans has been in the range of 5% to 6%, which is very close to India’s long-term average inflation rate.

The Guaranteed, Fixed Returns of Bima Jyoti

He then contrasted this with the Bima Jyoti plan, which is a ‘non-participating’ policy. Instead of a variable bonus, it offers ‘Guaranteed Additions’ at a fixed rate of ₹50 per ₹1000 of the Sum Assured each year. While this provides certainty, the advisor calculated that the effective IRR on the premium you pay is also in a similar, low range of around 4% to 5%.

The Verdict on Beating Inflation

The financial advisor’s conclusion was very direct. He said, “Neither of these plans should be considered an inflation-beating investment. Their primary purpose is capital protection and goal-based savings with an insurance component.” He explained that with returns so close to the rate of inflation, the real return (your return after accounting for inflation) on both these plans is likely to be close to zero or even slightly negative over the long term.