I have some digital gold on Paytm that I might need to sell soon. Can I sell it on a weekend? Also, when I sell, is there a 3% GST deduction, and do I have to pay any other tax?

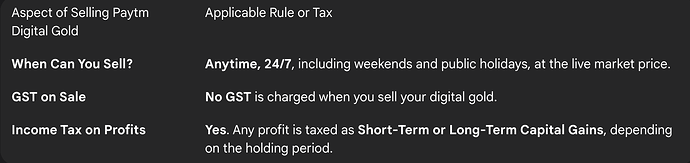

Yes, you can sell your Paytm digital gold at any time, 24/7. Regarding taxes, it’s important to know that GST is not charged when you sell. The only tax applicable is the capital gains tax on any profit you make from the transaction.

The Convenience of Selling Your Digital Gold Anytime

My friend needed to raise some funds for an emergency on a Sunday afternoon. He was worried he would have to wait until Monday for the markets to open. I reminded him about his digital gold on Paytm. He was able to log into the app, go to the ‘Gold’ section, and sell the required amount instantly, even on a weekend. The sell option is available around the clock.

Clarifying the Rule on GST When You Sell Gold

My aunt was concerned that she would have to pay 3% GST again when she sold her gold, eating into her returns. I had to reassure her by explaining that the 3% GST is a one-time tax that is paid only at the time you buy the digital gold. There is absolutely no GST charged or deducted from the proceeds when you sell it.

Understanding the Capital Gains Tax on Your Profits

I was discussing the tax implications of selling gold with my financial advisor. He explained that the only tax you need to consider when selling is the capital gains tax on your profit. If you sell the gold within three years of buying it, the profit is a short-term gain and is taxed according to your income tax slab. If you sell after three years, it is a long-term gain, which is taxed at 20% with the “benefit of indexation.”