I took a loan against my LIC policy last year. I just found out the interest rate has increased, but I never received any SMS or notice, and the app still shows the old rate. Can they do this?

Yes, LIC can and does change the interest rate on policy loans. This is because the loan is given on a variable or floating interest rate basis. While they announce these changes publicly, they are generally not required to send a personal notice to every borrower, and there can be a lag before the new rate is updated on the app.

Understanding That the LIC Loan Interest Rate is Variable

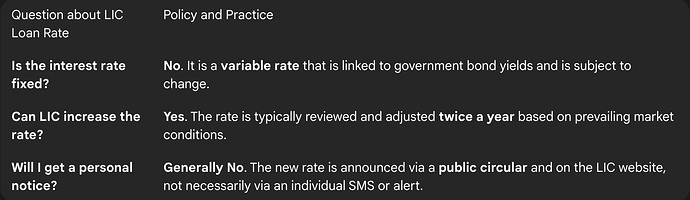

My friend, who had taken a loan against his policy, was surprised when he saw that his outstanding interest for the year had increased. I had to explain that unlike a fixed-rate personal loan, the interest rate on an LIC policy loan is not fixed for the entire loan tenure. It is a floating rate that is linked to the yields of government securities.

How and When the Interest Rate is Changed

I was discussing this with an LIC agent, and he confirmed the process. He said that LIC’s investment board reviews the rate periodically, usually twice a year. If the benchmark interest rates in the economy have gone up, LIC will increase its policy loan interest rate for the next six-month period. This is a standard and legal practice for this type of loan.

The ‘Notice’ is a Public Declaration, Not a Personal SMS

My friend’s main grievance was the lack of a personal notification. The agent clarified that with millions of borrowers, it is not feasible for LIC to send an individual SMS or letter to everyone. Instead, they issue a public circular with the new rates and update the information on their official website. He also mentioned that the digital app might take some time to reflect this change, so it may not always show the most current rate.

The Final Authority: Your Loan Agreement

The agent made the most important point at the end. He said that the loan agreement document that my friend signed when he first took the loan clearly contains a clause stating that the interest rate is variable and subject to periodic review by the corporation. This signed agreement is the legal basis for the change in the interest rate.