I am an NRI visiting India for a few months. I have an NRO account and an Indian mobile number. Can I open a PayZapp wallet to make payments while I’m here?

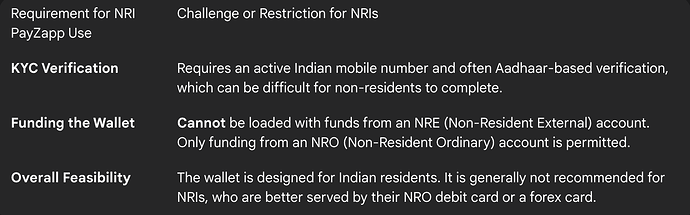

While it may seem straightforward, opening and fully using a PayZapp wallet as a Non-Resident Indian (NRI) is generally very difficult and often not feasible. This is due to strict regulations from the Reserve Bank of India (RBI) and the Foreign Exchange Management Act (FEMA) concerning KYC and the sources of funds for digital wallets.

The Challenge of KYC Documents for an NRI PayZapp Account

My cousin, who is an NRI, attempted to sign up for PayZapp during his last trip to India. He had an Indian SIM and a PAN card, but the process for upgrading to a Full KYC wallet required Aadhaar-based verification. As his Aadhaar was not actively linked to his current Indian mobile number, he couldn’t complete the process, which became the first major hurdle.

The Rule on Funding a PayZapp Wallet for NRIs

I was speaking with a friend who is a financial advisor, and he pointed out the most significant restriction. An NRI is not permitted to load a digital wallet from their NRE (Non-Resident External) bank account. Funds can only be added from an NRO (Non-Resident Ordinary) account, which holds your income earned in India. This severely limits how an NRI can top up their wallet.

Why PayZapp and Other Wallets Are Primarily for Residents

My uncle, an NRI, discussed this directly with HDFC Bank. The bank staff explained that digital wallets are classified as domestic payment instruments and all their features and regulations are designed for Indian residents. Due to the complexities of international fund management rules, it’s generally recommended that NRIs use more suitable options like their NRO debit card for UPI and other payments while in India.

Hii there, here’s what I found about whether NRIs can open and use the PayZapp wallet in India, based on my recent reading and some caveats you’ll want to know.

What you can do:

• PayZapp, offered by HDFC Bank, allows users in India to make payments (wallet, UPI, linked bank account) via the app.

• For NRIs, there has been regulatory allowance for using UPI via NRE/NRO accounts linked to Indian banks—even with international mobile numbers in some cases.

Key limitations for NRIs with PayZapp:

• The official documentation for PayZapp itself does not clearly state support for NRIs who hold only NRE/NRO accounts using international mobile numbers.

• Since PayZapp is primarily wallet + payment app tied to Indian mobiles/banks, your ability to use it as an NRI may depend on:

1. Having an Indian-mobile number linked to your Indian bank account.

2. Having the bank account type supported by PayZapp (which may require resident status).

3. Whether HDFC Bank treats your account and mobile number as eligible for the wallet and UPI features in the app for NRIs.

Official Link:

Here’s the official link for PayZapp: