Hey Finanjo fam! Tax season is around the corner and I’m trying to figure out my deductions. I have a term insurance policy (ICICI Pru iProtect Smart) and I’m paying about 15k annually in premiums.

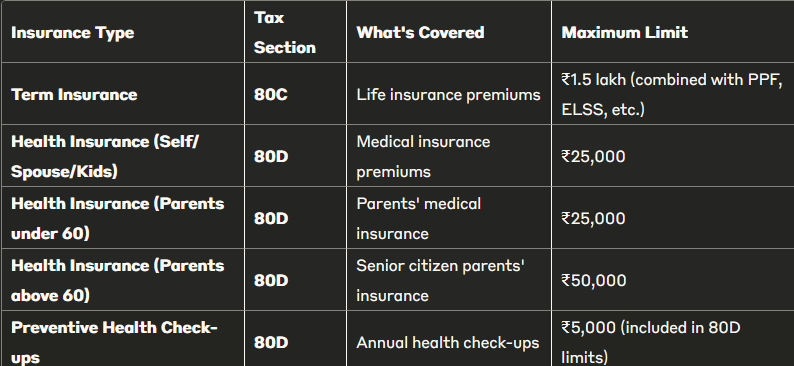

I know health insurance premiums can be claimed under 80D, but what about term insurance? Some people are telling me it goes under 80C, others say 80D. I’m getting totally confused!

Also, I have both term insurance and a separate health insurance policy. Can I claim both under different sections or is there some limit I need to worry about?