I am a complete noob and this is the first time filing ITR. So I purchased some 5 units of GIFT NIFTY ETF and sold it within a week. The amount is not huge though, just around 1k. I saw in some websites that profits earned through capital gains are filed with ITR-2. I also purchased a mutual fund. Since the amount is not that big, can I file with ITR 1 or should proceed with ITR-2?

You must use ITR-2, even if the profit is only ₹1,000.

- Any sale of shares, ETFs (including GIFT NIFTY ETF) or mutual-fund units creates capital gains—whether the amount is ₹1 or ₹1 lakh.

- Indian tax rules do not allow capital-gains income in ITR-1 .

- The only exception is long-term equity gains up to ₹1.25 lakh reported under section 112A, and that too only if you have no other capital gains .

- Your short-term trade (held < 12 months) does not qualify for this relaxation, so ITR-2 is compulsory.

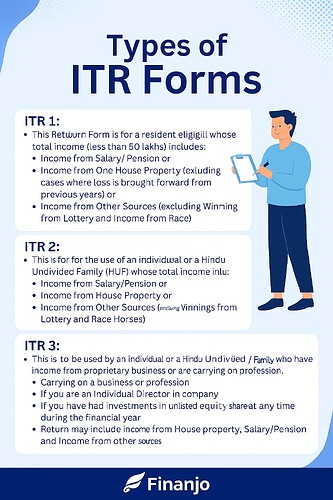

Heres a small guide I find on this community

Totally get where you’re coming from. First time filing ITR can be confusing, especially with all the different forms floating around. Here’s the simple version:

ITR-1 is for salaried people with basic income like salary, interest, or rent from one house. But the catch is, it doesn’t allow any capital gains at all. Not even one rupee. So even though your gain is small, like ₹1,000 from selling the GIFT NIFTY ETF, that’s technically a capital gain and ITR-1 is out.

Since you’ve sold that ETF and maybe even a mutual fund (if sold), you’ll need to file ITR-2. It’s the form meant for people with capital gains, whether big or small.

So yeah, even though the amount is tiny, the rule is about the type of income, not how much it is. ITR-2 is your pick. It’s a little longer to fill but pretty straightforward if you use a good platform or the income tax site.