I have some digital gold in my ICICI Bank iMobile app. Can I convert this into a physical gold coin or even a piece of jewellery?

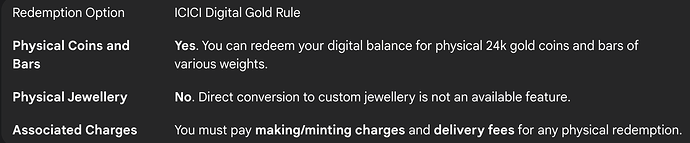

Yes, you can redeem your ICICI digital gold for physical 24-carat gold coins and bars. This is a core feature of the product. However, direct redemption in the form of custom jewellery is not a supported option.

Redeeming Your ICICI Digital Gold as Physical Coins and Bars

My friend, who invests in digital gold through his ICICI Bank account, wanted to get a physical coin as a gift. I showed him that within the ‘Gold’ section of his iMobile Pay app, there is a ‘Redeem’ or ‘Request Delivery’ option. This allowed him to browse a full catalogue of certified 24k gold coins and bars from the provider, MMTC-PAMP.

Understanding the Charges for Physical Redemption

When my friend selected a 5-gram coin for delivery, the app displayed a clear breakdown of the final charges. He had to use his 5 grams of digital gold balance and also pay the additional making charges for manufacturing the coin, plus a fee for secure and insured delivery to his home. These are the standard costs for converting a digital holding into a physical product.

The Rule for Redeeming as Jewellery

My aunt had a different goal; she wanted to use her digital gold to purchase a pair of earrings. I had to explain that this is not possible directly. The ICICI digital gold product is for investment-grade bullion (coins and bars). To get jewellery, she would first have to sell her digital gold on the app, have the money credited to her ICICI bank account, and then use those funds to buy jewellery from a Tanishq, Malabar, or any other jeweller she prefers.