Effective June 10, 2025, Cardholders of Tata Neu Infinity and Tata Neu Plus credit cards can now spend at least ₹50,000 in a calendar quarter to receive two complimentary domestic lounge vouchers.

Does the ₹50,000 spend need to be on Tata Neu only, or across all categories?

I don’t think so,

The ₹50,000 spend does not need to be only on Tata Neu. It is counted across all categories and merchants on your Tata Neu Infinity or Tata Neu Plus credit card.

You just have to spend ₹50,000 using your Tata Neu Infinity or Tata Neu Plus credit card to receive the reward of two complimentary domestic lounge vouchers.

When I first used my HDFC Bank credit card for airport lounge access, I simply swiped it at the lounge counter and walked in. It was straightforward and hassle-free. However, I recently learned that HDFC Bank has updated its lounge access policies, and the process has become more structured. Here’s what you need to know:

Changes to Lounge Access for HDFC Bank Credit Cardholders:

Effective June 10, 2025, HDFC Bank has revised its domestic airport lounge access policy for Tata Neu Infinity and Tata Neu Plus credit cardholders. The key changes are:

• Swipe-to-Access Discontinued: You can no longer access lounges by swiping your card at the lounge counter.

• Voucher-Based Access: Lounge access is now granted through vouchers. To receive a voucher, you must spend at least ₹50,000 in a calendar quarter.

• Voucher Limit: Tata Neu Infinity cardholders can avail up to two complimentary lounge vouchers per quarter (maximum eight per year). Tata Neu Plus cardholders can avail one voucher per quarter (maximum four per year).

• Voucher Validity: Once you meet the spending criteria, you’ll receive a voucher via SMS or email. The voucher remains valid for 180 days from the date of issuance.

• Tracking Eligibility: You can monitor your spending and voucher eligibility through HDFC Bank’s NetBanking or MobileBanking platforms.

Lounge Access for Other HDFC Bank Credit Cards:

Regalia Credit Card: To avail lounge access, you need to complete a minimum of four retail transactions. After meeting this criterion, you can apply for a Priority Pass membership, which offers up to six complimentary lounge accesses per year. Additional visits will incur a charge of $27 plus GST per visit.

Millennia Credit Card: As of December 1, 2023, complimentary lounge access has been discontinued. Lounge access is now integrated into the Quarterly Spends Milestone program. By spending ₹1 lakh or more in a calendar quarter, you become eligible for a ₹1,000 voucher, which can be redeemed for lounge access or other benefits.

Important Notes:

Spending Criteria: Only retail transactions qualify towards the spending threshold. ATM withdrawals and wallet loadings are not considered.

New Customers: If you’ve recently received your HDFC Bank debit card, you may be eligible for complimentary lounge access for the first two calendar quarters without meeting the spending criteria.

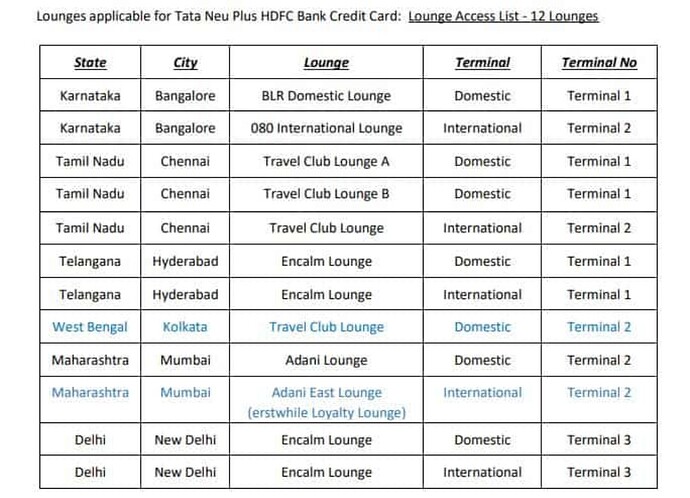

Lounge Availability: Access is limited to participating lounges. It’s advisable to check the list of eligible lounges before planning your visit.