I’m buying health insurance for my parents (aged 62 and 64). I’m confused between taking one family floater plan to cover both of them or buying two separate individual policies. The floater plan seems cheaper, but I’m worried about the shared cover. What is the better and safer option for them?

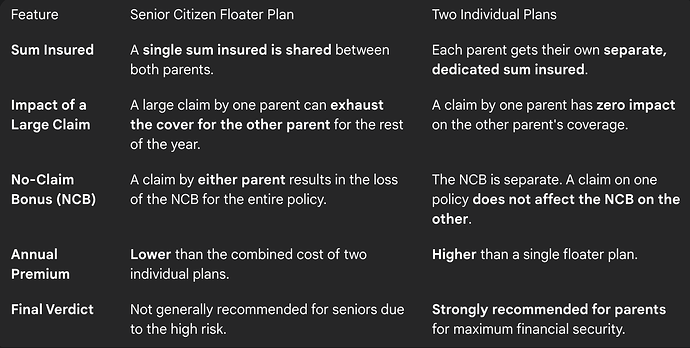

Choosing between a single family floater plan and two individual policies for your senior citizen parents is a critical decision. While a floater plan is often cheaper, individual plans provide a dedicated sum insured for each parent, which is a much safer option given the higher health risks associated with older age.

Shared Coverage: The Risk of a Floater Plan for Parents

A colleague of mine learned this the hard way. He had a ₹10 lakh floater plan for his parents. His father underwent a major heart procedure that used up ₹8 lakh of the cover. Just a few months later, his mother had an emergency hospitalization, but there was only ₹2 lakh left in their shared policy for her treatment for the rest of the year. He had to pay the large remaining amount himself.

Dedicated Coverage: The Security of Individual Health Insurance

After hearing my colleague’s story, I opted for two separate ₹10 lakh individual plans for my parents when I bought their insurance. Last year, my mother had a knee replacement surgery that cost around ₹5 lakh, and her individual policy covered it completely. This had absolutely no impact on my father’s separate ₹10 lakh policy, which remained fully intact and available for him. This dedicated coverage for each of them was a huge relief.

Comparing the Premiums: Floater vs. Individual Plans

When I was getting quotes from an agent, a single ₹10 lakh floater plan for my parents was about ₹55,000 annually. In comparison, two separate ₹10 lakh individual plans came to a total of about ₹65,000. While I had to pay ₹10,000 more for the year, I was effectively getting a total of ₹20 lakh in dedicated coverage for them, instead of a shared pool of ₹10 lakh. The extra cost felt completely justified for double the protection.

No-Claim Bonus in Floater vs. Individual Plans for Parents

A friend who also has individual plans for his parents highlighted another benefit. His father made a small claim last year, so at renewal, he didn’t get the No-Claim Bonus on that specific policy. However, his mother’s policy was claim-free, so her sum insured was increased with the NCB. With a floater plan, a single claim made by either parent would have resulted in losing the bonus for the entire policy.