When I was reviewing LIC ULIP as an investment option for myself, I had a doubt about how the disclosure process actually works. I wanted to know how often LIC updates fund performance and where I can check it. Can someone explain?

LIC ULIPs (Unit Linked Insurance Plans) are regulated products that combine insurance with market-linked investments. Since they involve equity and debt exposure, disclosures are made regularly to keep policyholders informed about fund performance, charges, and NAVs. Understanding how LIC ULIP disclosure works helps investors make better decisions about continuing, switching, or partially withdrawing funds.

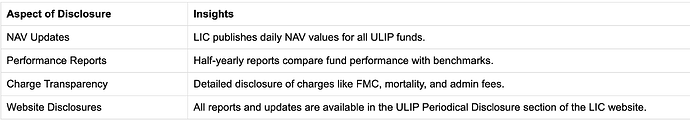

Key Aspects of LIC ULIP Disclosure:

Regular NAV Updates for LIC ULIP Disclosure

A colleague of mine mentioned that LIC updates the Net Asset Value (NAV) of its ULIP funds on a daily basis. This allows investors to track how their investments are performing in real time and decide if they need to switch between debt and equity options.

Half-Yearly Fund Performance Reports for LIC ULIP Disclosure

I came across a forum where someone explained that LIC provides detailed half-yearly disclosures of ULIP fund performance. These reports show how each fund is doing compared to its benchmark, which helps policyholders check if their money is managed efficiently.

Expense & Charge Transparency for LIC ULIP Disclosure

When I reviewed a family member’s policy, I noticed LIC clearly states the charges deducted under ULIPs, such as fund management charges and mortality charges. This level of transparency made it easier to see how much was actually going into the investment portion.

ULIP Periodical Disclosure Section for LIC ULIP

Another investor I spoke with shared that all these details are consolidated under the ULIP Periodical Disclosure section on the LIC official website. He found it helpful to download reports directly from there instead of relying only on policy statements.