My aunt is traveling from the USA and wants to bring me a gold necklace as a wedding gift. Is there any special exemption from customs duty because it’s a gift from a close relative?

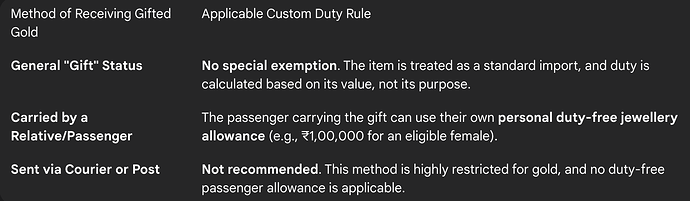

For the purpose of calculating customs duty, Indian law makes no distinction between an item purchased for personal use and an item intended as a gift. There is no special “gift” exemption for gold. The standard customs rules and duty-free allowances are applied to the passenger who is bringing the gold into the country.

No Gift Exemption at Indian Customs

My cousin was expecting her brother to bring her a gold set as a gift from Dubai and assumed it would be tax-free. I had to clarify a common point of confusion: the customs duty is an import tax on the item itself, not on the purpose of the import. Therefore, the ‘gift’ status of the gold has no bearing on the customs duty that needs to be paid.

How Duty is Calculated for a Gift Carried by a Passenger

When my aunt was bringing a necklace as a gift for me, the customs rules were applied to her as the passenger carrying the item. She was eligible for her personal duty-free jewellery allowance of ₹1,00,000 (as a female residing abroad for over a year). Since the necklace she was gifting was valued within this limit, she was able to bring it into India without paying any duty. If its value had been higher, she would have had to pay duty on the excess amount.

The Problem with Sending Gold Gifts via Courier or Post

My uncle, who lives in Canada, once considered sending me a gold ring through an international courier. I researched the rules and strongly advised against it. The import of gold by individuals through postal or courier services is highly restricted in India. My friend who had a relative try this found the package was detained by the customs department, and it was a complicated and expensive process to clear it, as no passenger duty-free allowances apply in this case.