I’ve just started working and noticed that a part of my salary goes towards EPF every month. Could you please explain how much EPF contribution is deducted from my salary in India and how this contribution is calculated?

When I got my first job, I was also curious about why my in-hand salary looked slightly less than what was mentioned in the offer letter. That’s when I learned about the Employees’ Provident Fund (EPF) contribution.

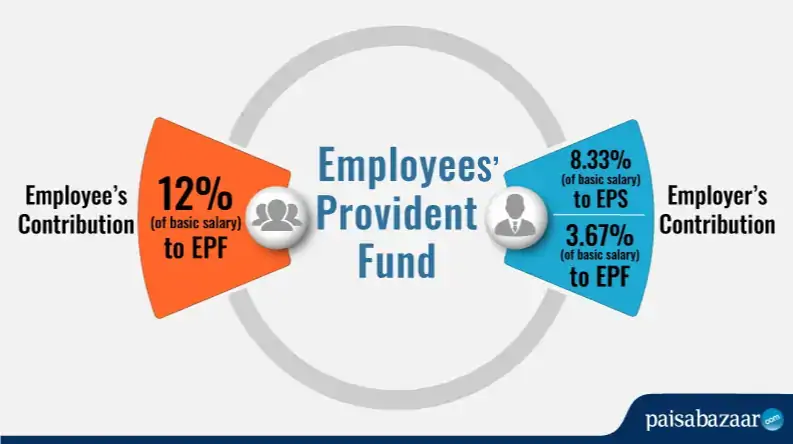

In India, typically 12% of your basic salary plus dearness allowance is deducted every month as your EPF contribution. The same amount (12%) is also contributed by your employer, but it’s split—part of it goes into your EPF account and part into the Employee Pension Scheme (EPS).

So, for example, if your basic pay is ₹20,000 per month, then ₹2,400 (12% of ₹20,000) will be deducted from your salary as your EPF contribution. Your employer will also contribute ₹2,400, though not all of it goes directly to EPF.

This contribution ensures that you are building a retirement corpus steadily, even without actively thinking about savings.

For more details, you can check the official EPFO website here: