I’m traveling from Dubai to India and was thinking of buying gold there because I’ve heard it’s cheaper. After paying all the customs duties, is there still a significant price difference or saving?

While the base price of gold is typically lower in Dubai, after factoring in India’s current customs duties and GST, the final cost of legally imported gold is often higher than the local market price in India. The high taxes usually eliminate, and can even reverse, any potential savings.

Comparing the Base Gold Price Between Dubai and India

My friend was planning a trip and asked me to compare the gold prices. I checked that on September 20, 2025, the price for 24-carat gold in Dubai was approximately 260 AED per gram. At the current exchange rate, this translates to about ₹5,980 per gram. On the same day, the local price in India was around ₹6,800 per gram, making the initial price in Dubai seem much cheaper.

Calculating the Cost of Dubai Gold After Indian Customs Duty

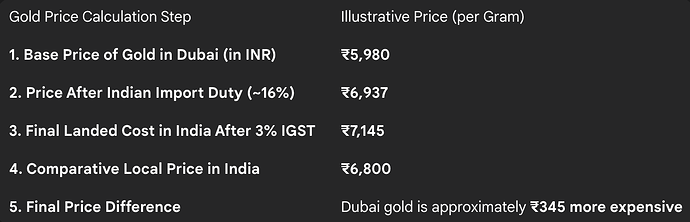

I then helped my friend calculate the final landed cost. We took the Dubai price of ₹5,980 and added the effective import duty of 16% (which includes Basic Customs Duty, Cess, and Surcharge). On top of that new value, we calculated the final 3% IGST. After all the taxes were applied, the final cost of one gram of gold imported from Dubai came out to be approximately ₹7,145.

The Final Verdict on the Price Difference

When we compared the final figures, the conclusion was clear and surprising. The gold from Dubai, after being legally imported and all duties paid, would cost around ₹7,145 per gram. In contrast, he could buy it locally in India for just ₹6,800 per gram. I explained that due to the high import taxes, the long-held belief that buying gold in Dubai is cheaper is often not true for those who declare it legally at customs.