My Max Life term insurance premium of ₹50,000 is due next week. I usually pay it directly on their website with my debit card. Are there better options? What is the best way to pay the premium to get the maximum possible cashback or rewards on this large amount?

Getting the maximum cashback on a large Max Life premium payment involves choosing the right payment method, which is usually a high-yield cashback credit card. While paying directly with a debit card is easy, routing the transaction through specific apps or, more importantly, using the right credit card can result in significant savings.

Axis Bank ACE Card: Direct Premium Cashback

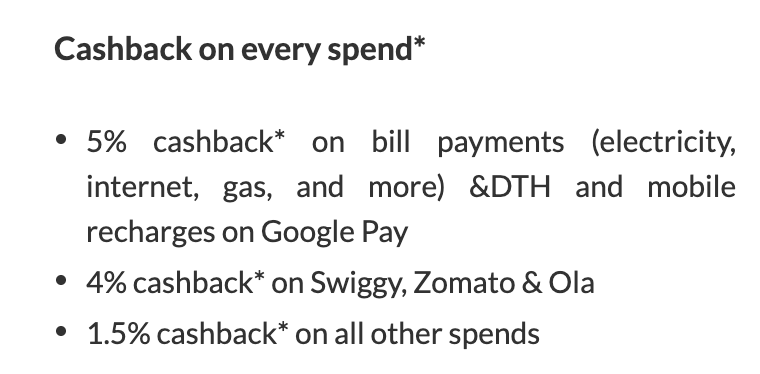

A friend of mine pays a large insurance premium, and his strategy is simple: he uses his Axis Bank ACE Credit Card. He pays directly on the Max Life website, and because insurance payments are typically treated as utility or bill payments by this card, he gets a straight 5% cashback. On his ₹40,000 premium, that’s a direct saving of ₹2,000, which is often the best possible return.

credits : Apply for Axis Bank's ACE Credit Card Online

Amazon Pay ICICI Card: Cashback via Amazon App

My cousin uses her Amazon Pay ICICI Credit Card for nearly all her expenses. She checked and found Max Life Insurance was listed as a biller in the Amazon app’s insurance payment section. By paying her premium through the app using this specific card, she got the full 5% cashback credited to her Amazon Pay balance. This is a fantastic option if you hold this card and the insurer is available on their platform.

HDFC Millennia Card: Cashback through SmartBuy

I was exploring options for my own premium and checked the HDFC SmartBuy portal. I hold an HDFC Millennia card, and the portal often has special offers for bill payments made through it. Paying the insurance premium via SmartBuy is a reliable way for HDFC cardholders to ensure they qualify for the highest 5% cashback tier on their specific card, which might not apply for a direct payment on the merchant’s site.

Small Cashback Offers from Wallet Apps

I recently saw an ad on CRED for “guaranteed rewards on bill payments.” I paid a smaller utility bill through them and got about ₹15 in cashback. A colleague had a similar experience with a Paytm offer for an insurance payment. These app-specific offers are usually small, fixed amounts or random “scratch card” rewards. They are a nice little bonus but won’t provide the substantial percentage-based cashback on a large premium that a good credit card will.