I’m considering applying for an HSBC credit card, but I’m worried about the annual fee. Is there a way to get the fee waived in India, and if so, what spending conditions do I need to meet?

When I was looking into HSBC credit cards, one of my colleagues mentioned that he didn’t pay any annual fee at all because his spending was high enough to qualify for a waiver. That got me curious, so I dug deeper into how exactly the annual fee waiver works with HSBC cards in India.

Annual Fee Structure for HSBC Credit Cards in India:

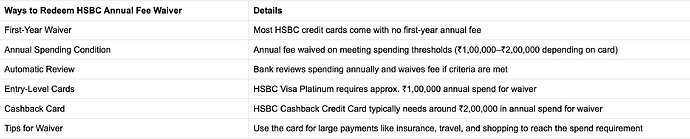

From what I’ve seen, HSBC cards generally have a first-year fee waiver, meaning you don’t pay anything upfront. After that, an annual fee is applicable, which varies depending on the specific card. However, I read on a finance forum that these fees can often be waived if you meet certain annual spending thresholds.

How the HSBC Credit Card Annual Fee Waiver Works in India:

A friend of mine explained that the waiver isn’t automatic unless you meet the required spend. For example, if the condition is spending ₹1,00,000 in a year, the bank reviews your transactions at the end of the cycle and waives the annual fee if you qualify. If you don’t meet the condition, the fee is charged directly to your statement.

Spending Thresholds for HSBC Credit Card Fee Waiver in India:

The spending requirement differs across cards. For entry-level cards like the HSBC Visa Platinum, I noticed the waiver is available if you spend around ₹1,00,000 annually. My colleague who uses the HSBC Cashback Credit Card said his waiver kicked in after he crossed ₹2,00,000 in spends. Higher-end cards often have larger thresholds.

Tips to Ensure HSBC Credit Card Annual Fee Waiver in India:

I read online that many users recommend consolidating big expenses like insurance premiums, travel bookings, and shopping onto the HSBC card to hit the required spend. Some also mentioned setting reminders to track their yearly spend so they don’t fall short of the waiver condition.