I want to set up autopay for my HSBC credit card in India. How can I automate my monthly payments to avoid late fees?

I often forget credit card due dates, which can lead to late fees and interest charges. When I explored HSBC’s autopay facility, I realized it allows me to automate monthly payments from my bank account. This way, I can ensure timely payments while managing my finances more efficiently.

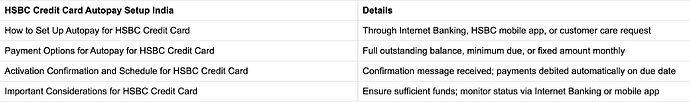

How to Set Up Autopay for HSBC Credit Card

I found that I can set up autopay through multiple channels. Logging into HSBC Internet Banking, I can link my savings or current account to my credit card and select the amount to be debited every month. Alternatively, I can register for autopay via the HSBC mobile app or call customer care to request activation.

Payment Options for Autopay for HSBC Credit Card

I discovered that I can choose between paying the minimum amount due, the full outstanding balance, or a fixed amount each month. Selecting the full outstanding balance ensures I avoid interest charges, while a fixed amount helps manage cash flow more predictably.

Activation Confirmation and Schedule for HSBC Credit Card

After setting up autopay, I received a confirmation message from HSBC confirming the schedule and the linked account. Payments are automatically debited on the due date every month, giving me peace of mind that I won’t miss a payment.

Things to Keep in Mind for HSBC Credit Card

I also learned that it’s important to ensure sufficient funds are available in the linked account on the debit date. Failing to maintain the balance can lead to failed transactions and potential late fees. Monitoring the autopay status via Internet Banking or the mobile app helps me avoid such issues.