I have an HSBC credit card and was wondering how the upgrade process to HSBC Platinum works in India. What are the steps, eligibility, and benefits involved?

A friend of mine shared that he recently upgraded his HSBC credit card to the Platinum variant and the process was fairly simple once he met the eligibility criteria. He explained that the upgrade not only unlocked better privileges but also improved his reward earning potential. After reading a few more experiences online, I realized the upgrade can be a smart move for many existing HSBC cardholders.

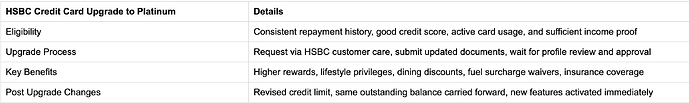

Eligibility for HSBC Credit Card Upgrade to Platinum in India:

One of my colleagues mentioned that his request for a Platinum upgrade was approved only after he maintained consistent repayment history and used his card actively for a year. HSBC generally considers your credit score, repayment track record, and spending patterns before approving such upgrades.

Process to Upgrade HSBC Credit Card to Platinum in India:

Someone I know explained that the process started with contacting HSBC customer care and placing an upgrade request. He was then asked to provide updated income proof and verification documents. Once submitted, HSBC reviewed his profile and confirmed the upgrade within a few working days.

Benefits of Upgrading HSBC Credit Card to Platinum in India:

Another friend highlighted that the biggest benefit of moving to the Platinum card was access to higher rewards on daily spending along with lifestyle perks such as airport lounge access and dining discounts. The card also comes with fuel surcharge waivers and added insurance coverage, which makes it more versatile compared to entry-level cards.

Things to Expect After the Upgrade to HSBC Platinum Credit Card in India:

A cardholder on a finance forum shared that while the Platinum upgrade unlocked better features, the bank also revised his credit limit based on income and usage history. He also pointed out that any outstanding dues from the previous card simply carried forward without disruption.