I frequently travel abroad and was told that the HSBC Premier Travel Credit Card has competitive forex markup fees. How much does it actually charge for international transactions, and is it worth using compared to other travel cards?

When I first considered the HSBC Premier Travel Credit Card, one of the key things I wanted to know was how much I’d be charged for overseas spends. A friend of mine who used the card during a Europe trip mentioned that the forex markup was lower than many standard cards, which made his purchases abroad more cost-effective. That made me curious to check the exact details.

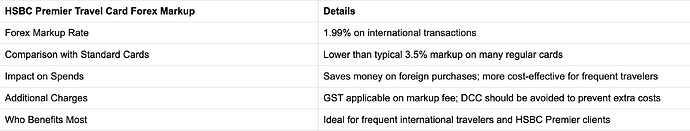

Forex Markup Rate on HSBC Premier Travel Card in India:

From what I’ve gathered, the HSBC Premier Travel Card usually charges a forex markup of around 1.99% on international transactions. This is lower than the 3.5% charged by many entry-level and mid-range cards. I read online that this reduced markup can make a noticeable difference for frequent travellers who spend in foreign currencies often.

How Forex Markup Impacts International Spends on HSBC Premier Travel Card in India:

A colleague once explained to me that forex markup is basically an additional fee on top of the currency conversion rate when you swipe your card abroad. With the HSBC Premier Travel Card, the slightly lower markup means you save on every transaction. For example, someone spending $1,000 abroad could save a decent amount compared to using a regular card with higher charges.

Benefits of Lower Forex Markup on HSBC Premier Travel Card in India:

I came across a few user experiences on travel forums where people highlighted that this lower forex fee, combined with travel rewards, made the card especially useful for frequent flyers. Some also mentioned that the card pairs well with HSBC Premier banking privileges, which makes it even more attractive for global travellers.

Key Features About HSBC Premier Travel Card Forex Usage in India:

Another friend reminded me that while the markup is lower, there may still be GST applicable on the fee. It’s also important to note that dynamic currency conversion (DCC) should be avoided while swiping abroad, since it can lead to higher costs regardless of the markup.