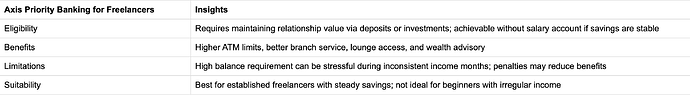

As a freelancer, I’m curious whether Axis Priority Banking would suit my financial needs. Since I don’t have a fixed monthly salary but get variable payments from multiple sources, is this program good or bad for someone like me?

Axis Priority Banking is marketed as a premium banking service with exclusive benefits such as higher withdrawal limits, priority service at branches, and wealth management support. However, freelancers often face irregular cash flows, so evaluating whether the requirements and benefits align with freelance income patterns is important.

Axis Priority Banking Eligibility for Freelancers

A friend of mine who freelances in digital design shared that Axis required him to maintain a minimum relationship value (usually through deposits or investments) to qualify. Since he didn’t have a salary account, he relied on his fixed deposits and recurring payments credited to his Axis account to meet the eligibility. He mentioned that while it was possible, it required discipline to maintain the threshold.

Axis Priority Benefits for Freelancers

From my experience, the service quality was noticeably better than a normal savings account. I was able to access higher ATM withdrawal limits, faster branch support, and even lounge access during travel. For freelancers who need flexibility and often deal with varying client payments, these perks can feel like an upgrade in convenience.

Axis Priority Limitations for Freelancers

My colleague, who works as a freelance consultant, pointed out that the main drawback was the balance requirement. Since his income fluctuated, there were months when maintaining the minimum balance was stressful. He said the penalties for falling short ate into his earnings, which made the program feel restrictive compared to a standard savings account.

Axis Priority Suitability for Freelancers

After reviewing these perspectives, I felt that Axis Priority works best for freelancers who already have stable savings or investments to consistently meet the eligibility criteria. Those starting out with irregular income may find the program less practical, as the penalties could outweigh the perks.