I’ve started exploring the Account Aggregator (AA) system and came across Finvu as one of the platforms. I’m concerned about my bank and financial data being handled securely. Is Finvu AA safe enough to trust with this sensitive information?

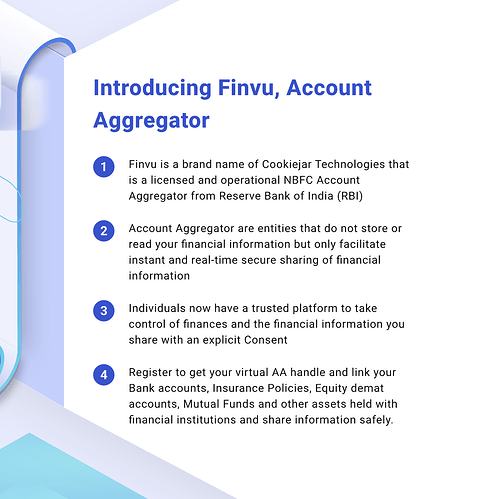

Finvu is an RBI-licensed NBFC Account Aggregator that supports the official AA framework in India. It’s designed to securely share financial data between banks (Financial Information Providers or FIPs) and service providers (Financial Information Users or FIUs), but the safety of such platforms is often a major concern for users.

Is Finvu Account Aggregator Safe for Your Bank Data?

When I first heard about Finvu Account Aggregator (AA), I was skeptical about whether sharing bank data through such a platform was truly secure. Later, after going through some industry insights and user feedback, I realized there are several safeguards built into the system. Here’s what I found:

credits : https://aaweb.finvu.in/

Regulatory Oversight & Encryption Protocols for Finvu AA:

Finvu works under RBI authorization and follows the framework set by Sahamati, the AA industry body. The data transfer is end-to-end encrypted, moving securely from your bank to the requesting institution. Importantly, Finvu does not store, read, or process this data—it only facilitates encrypted transfer between entities.

Consent-Based Data Sharing for Finvu AA:

Every bit of data sharing happens only with your explicit permission. You decide what information to share, with which institution, and for how long. The best part is, you can revoke your consent at any time, which ensures you always remain in control of your data.

Secure Infrastructure for Finvu AA:

Finvu operates on a robust cloud-based infrastructure. With measures like DDoS protection, real-time monitoring, and disaster recovery systems, the platform ensures your data remains encrypted, protected, and compliant with security standards at every stage.

Data Blind Approach for Finvu AA:

Unlike many intermediaries, Finvu cannot actually see or use your information. The AA framework ensures that Finvu only acts as a secure hand-off mechanism—passing encrypted data packets from Financial Information Providers (FIPs) like banks to Financial Information Users (FIUs) like lenders or fintech apps.

Investor Confidence and Partnerships for Finvu AA:

The platform has already raised significant funding to enhance its infrastructure and continues to partner with leading banks in India. This backing indicates strong confidence in its long-term role within the financial data ecosystem.

Real-World Feedback for Finvu AA:

From what I’ve read on finance forums, many users see Finvu as a secure, consent-driven platform. However, some have pointed out that the accuracy of data aggregation depends on how efficiently different banks are integrated with the AA network.

Yes, Finvu is one of the most prominent account aggregators in India and it is considered to be safe.

All the account aggregators, including Finvu follow strict data protection guidelines set by the RBI to ensure that there are no chances of breach of data and that the data transfer happens securely and the data is stored with 256 bit encryption whenever possible. At the same time, RBI has also mandated that any FIU, which is making use of this data, is a regulated entity that ensure data protection compliances.

Hi Anshuil think of Finvu like a super-secure courier or postman. It doesn’t peek at your stuff, it just moves your bank data (all locked up and encrypted) from point A to point B, but only after you say “yes.” Since it’s licensed by the RBI and you can pull back consent anytime, the control really stays in your hands.