I am considering joining HDFC Imperia and want to know if it is worth it under the new tax regime. How do the benefits compare with costs, and who truly gains from this program?

Is HDFC Imperia Banking Worth Joining Under the New Tax Regime 2025: Qualifications, Benefits, Costs

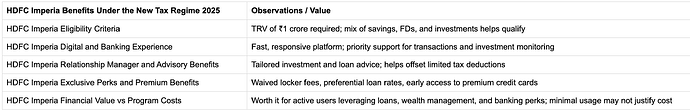

HDFC Imperia is designed for high-net-worth individuals seeking premium banking services, but the new tax regime changes the financial equations slightly. Understanding the eligibility, benefits, and costs is key to deciding whether the program aligns with your financial goals.

HDFC Imperia Eligibility Criteria in 2025

I was able to join HDFC Imperia after maintaining a Total Relationship Value (TRV) of ₹1 crore across savings, fixed deposits, and investments. The eligibility is straightforward, but having a mix of accounts and investments makes the process faster. Knowing these requirements beforehand ensures you can plan your balances effectively.

HDFC Imperia Digital and Banking Experience

I found the digital banking experience under HDFC Imperia very efficient. Fund transfers, investment monitoring, and account management were noticeably faster than standard accounts. Priority support for transactions makes everyday banking smoother, which is especially useful when optimizing finances under the new tax regime.

HDFC Imperia Relationship Manager and Advisory Benefits

I utilized the services of a dedicated Relationship Manager (RM), who provided guidance on investment planning and loan optimization. With fewer tax exemptions available under the new regime, personalized advice helped me manage my portfolio better and make strategic financial decisions.

HDFC Imperia Exclusive Perks and Premium Benefits

I benefited from waived locker fees, preferential loan rates, and early access to premium credit cards. These tangible perks provided noticeable savings and convenience, making the program valuable for someone actively using multiple banking and investment services.

HDFC Imperia Financial Value vs Program Costs

I analyzed the overall cost of maintaining the TRV and compared it to the benefits. For active users leveraging loans, wealth management services, and banking perks, the program delivers measurable financial value. For minimal users, however, the benefits may not outweigh the cost of maintaining the required TRV.