I was considering opening an HDFC Imperia Demat Account to get free AMC and priority investment services, but I’m unsure if it’s really worth it in 2025 for high-net-worth individuals.

The purpose of opening a demat account under HDFC Imperia is to open an account with the bank to maintain large balances or investments. The idea of the free AMC and premium investment services may look attractive, but it is necessary to realize the conditions of eligibility, transaction advantages, and whether the benefits match your own portfolio.

Eligibility for HDFC Imperia Demat Account

A friend of mine recently checked eligibility for this account and mentioned that maintaining a total relationship value of ₹1 crore across deposits, investments, and insurance premiums qualifies one. Others can also qualify if their monthly salary credit is above ₹3 lakh or if they maintain substantial balances in savings, current, or fixed deposit accounts. He noted that this ensures only premium clients get access, which explains the high-touch services.

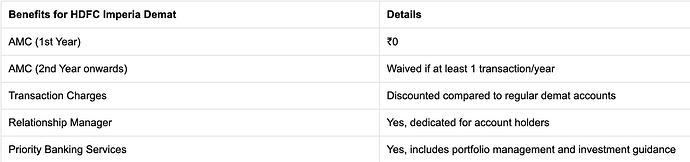

Benefits of Free AMC and Priority Services for HDFC Imperia Demat

From my own experience, I saw that the free annual maintenance charge for the first year, plus waived AMC in subsequent years with at least one transaction, makes the account financially attractive. In addition, having a dedicated relationship manager helped me navigate investment options and plan mutual fund allocations efficiently, something regular accounts do not provide.

Transaction Charges and Investment Flexibility for HDFC Imperia Demat

A colleague who uses the HDFC Imperia Demat Account highlighted that transaction charges are lower compared to standard demat accounts, especially for large-volume trades. He also valued the exclusive access to portfolio management services, which allowed him to diversify investments and manage multiple financial instruments from a single account efficiently.

Investment Flexibility and Portfolio Management Services for HDFC Imperia Demat

I experienced that the account’s integration with portfolio management services (PMS) and mutual fund investments was seamless. I could manage multiple asset classes without opening separate accounts, which made long-term planning and diversification simpler. The flexibility in managing trades, pledges, and investments from one platform was a major advantage for someone with a varied portfolio.

Suitability of HDFC Imperia Demat Account in 2025

A friend shared that this account is ideal for high-net-worth individuals who want personalized investment guidance, lower transaction costs, and access to priority banking services. For those with moderate investments or who rarely trade, the perks might not justify the requirements. It’s best suited for investors who actively manage large portfolios and value dedicated support.