I am considering investing through ICICI Wealth but am unsure if it provides better returns or advantages compared to direct mutual funds. How do the services, advisory, and costs compare?

ICICI Wealth offers portfolio management, financial advisory, and structured investment solutions, whereas direct mutual funds provide a DIY approach with lower costs. Understanding the differences in service, convenience, and potential returns can help you decide which route fits your goals.

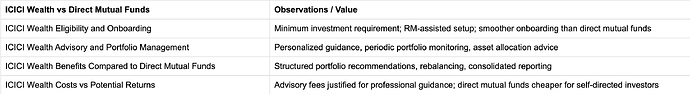

ICICI Wealth Eligibility and Onboarding

I was able to open an ICICI Wealth account after meeting the minimum investment requirement, which was straightforward. The onboarding process was smooth, and my RM guided me through documentation and account setup, making it easier than navigating multiple mutual fund platforms on my own.

ICICI Wealth Advisory and Portfolio Management

I found that the personalized advisory under ICICI Wealth helped me align my investments with my risk profile and financial goals. The RM suggested asset allocation strategies and monitored the portfolio periodically, which is something direct mutual funds do not provide. This hands-on guidance can be particularly useful for investors who prefer professional input.

ICICI Wealth Benefits Compared to Direct Mutual Funds

I noticed that ICICI Wealth provided structured portfolio recommendations, periodic rebalancing, and consolidated reporting across multiple asset classes. While direct mutual funds offer lower expense ratios, ICICI Wealth’s bundled advisory and monitoring made me feel more confident about long-term financial planning.

ICICI Wealth Costs vs Potential Returns

I evaluated the advisory fees and compared them with potential gains. For someone actively seeking guidance and structured portfolio management, the additional cost is justified. For self-directed investors comfortable managing their own mutual funds, direct investments may be more cost-effective.