I want to start saving for my young daughter’s future education and marriage. I’m considering an LIC child plan or the Sukanya Samriddhi Yojana (SSY). Which is the better option for higher returns?

If you are saving for a girl child, the Sukanya Samriddhi Yojana (SSY) is a significantly better and more rewarding option than a traditional LIC child plan. The SSY is a government-backed scheme that offers a much higher, guaranteed, and tax-free interest rate, making it a superior tool for long-term wealth creation for a daughter.

The First and Most Important Condition: Eligibility

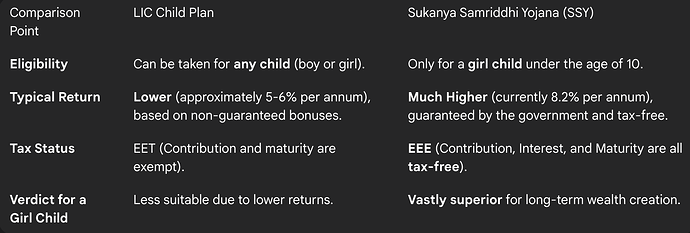

I was discussing this with my friend who has both a son and a daughter. He quickly learned that the Sukanya Samriddhi Yojana is a special government scheme that is available only for a girl child who is under the age of 10. For his daughter, it was the best option, but for his son, it was not applicable at all. LIC child plans, on the other hand, can be purchased for any child, boy or girl.

Comparing the Returns: Guaranteed High Interest vs. Low Bonus

A financial advisor showed me the stark difference in returns between the two. The SSY account offers a high, government-guaranteed interest rate, which as of October 2025, is 8.2% per annum, and this interest is compounded and completely tax-free. An LIC child plan, being a combination of insurance and investment, provides a much lower effective return (IRR), typically in the range of 5-6%, which is based on non-guaranteed annual bonuses.

The Triple Tax Benefit of Sukanya Samriddhi

My advisor highlighted the unbeatable tax status of SSY. It has an Exempt-Exempt-Exempt (EEE) status, which is the best possible tax classification. This means the contribution you make is tax-deductible under 80C, all the interest you earn is tax-free, and the final maturity amount is also completely tax-free. While an LIC plan also offers some tax benefits, the combination of a very high interest rate and EEE status makes SSY the clear winner for a girl child’s future.

As someone who has helped friends and relatives plan long-term savings for their children, I’ve noticed a clear divide — some prefer the simplicity and high interest of Sukanya Samriddhi, while others feel more secure with LIC child plans that combine insurance and savings.

Personally, if I’m thinking strictly about steady returns, SSY feels unbeatable. But when families ask for protection plus maturity benefits, LIC plans definitely offer more layers of security.

Where Sukanya Samriddhi Wins in 2025

• Higher fixed returns (around 8.2%), completely risk-free.

• Tax-free investment + tax-free maturity, which LIC policies usually don’t fully match.

• Government-backed guarantee, ideal for conservative savers.

Where LIC Child Plans Have an Edge

• Life cover included, so if the parent isn’t around, the policy continues or pays out — SSY doesn’t offer this safety net.

• Flexible payouts aligned with education or milestones.

• Bonus earnings (in participating plans), which can increase returns if LIC declares strong bonuses.

Official link to explore LIC child

plans: