I’m a 30-year-old non-smoker looking for a ₹1 crore term insurance plan. I’ve narrowed my choices down to LIC’s Tech Term and a similar plan from Max Life. Which one is a better overall choice?

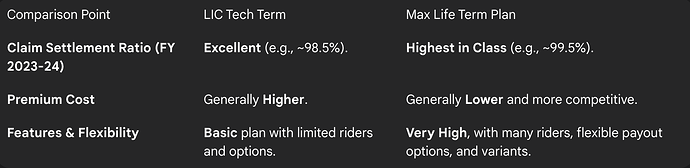

While both LIC and Max Life are excellent and highly reliable insurers, the “better” plan for a 1 crore cover depends on your priorities. Max Life’s plan is typically cheaper and more feature-rich with a marginally higher claim settlement ratio. LIC’s Tech Term plan offers the unparalleled security of a sovereign guarantee, but at a higher premium.

Comparing the Most Important Factor: Claim Settlement

I was discussing this with my financial advisor, as claim payment is the most crucial aspect of a term plan. He pulled up the latest official IRDAI report for the financial year 2023-24. The data showed that Max Life had a claim settlement ratio of 99.5%, which is among the highest in the entire industry. For the same period, LIC’s ratio was also excellent at 98.5%. The advisor noted that while Max Life has a slight edge, both figures represent top-tier reliability.

The Difference in Premium Cost

My friend, who is the same age and also a non-smoker, recently took quotes from both companies for a ₹1 crore term plan. He found that the annual premium for the Max Life plan was significantly lower than the premium quoted for the LIC Tech Term plan. This cost-effectiveness on premiums is a major reason why many people opt for leading private insurers for their term plans.

Features and Flexibility: Where Max Life Has an Advantage

My advisor also highlighted the difference in the product features. He explained that the LIC Tech Term is a very simple and straightforward online term plan with limited options. The Max Life plan, on the other hand, was much more flexible. It offered him additional benefits like an in-built critical illness rider, the option to have the claim paid out as a lump sum plus a monthly income for his family, and even a “return of premium” variant if he wanted.