I’m trying to decide if I should start using PayZapp. I want to know where it really shines. Is it a better app for paying my monthly utility bills, or is it more rewarding for online and offline shopping?

PayZapp is a highly effective platform for both shopping and bill payments, but its specific advantages in each category are most beneficial for HDFC Bank customers. While its bill payment system is robust for everyone, its shopping benefits can be exceptionally rewarding for those with HDFC cards.

Why PayZapp Excels at Managing Your Monthly Bills

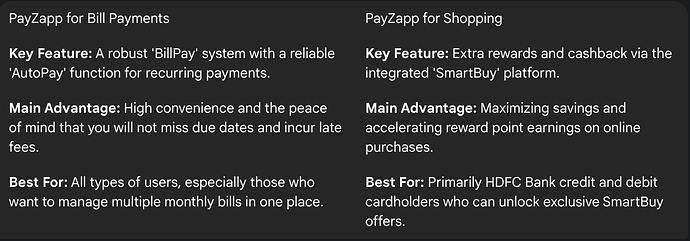

My friend uses PayZapp primarily as a bill management tool. He believes its ‘BillPay’ feature is superior because of its reliability and comprehensive list of billers, covering everything from his electricity provider to his loan EMIs. He has set up ‘AutoPay’ for all his recurring bills, which gives him peace of mind that he will never miss a due date. For him, this organized and dependable system makes it a top-tier app for bill payments.

Unlocking Extra Rewards using PayZapp for Shopping

On the other hand, my cousin, who is a rewards-focused shopper, argues that PayZapp’s real power is in shopping. She holds an HDFC Bank credit card and always pays on major sites like Amazon and Flipkart by going through PayZapp’s integrated ‘SmartBuy’ platform. By taking this extra step, she often gets 5% or more in accelerated rewards or direct cashback, a benefit she says is unmatched by other payment apps.

Which Feature is Better for You?

I was discussing this with a colleague, and we concluded that the “better” use case depends on the individual. For a user without an HDFC Bank card, PayZapp’s highly organized and reliable bill payment system is probably its most valuable feature. However, for an HDFC cardholder, the significant extra rewards earned via SmartBuy make it one of the most powerful shopping tools available.