PhonePe and HDFC Bank have recently launched co-branded credit cards. What are the key features of these cards, and how many variants have been introduced? What are the benefits of applying for this credit card, and is it possible to apply online?

Yes! PhonePe and HDFC Bank have launched two variants of their new co-branded RuPay credit card “Ultimo” and “UNO” both focused on UPI-linked rewards and app integrations. And yes, you can apply online through the PhonePe app.

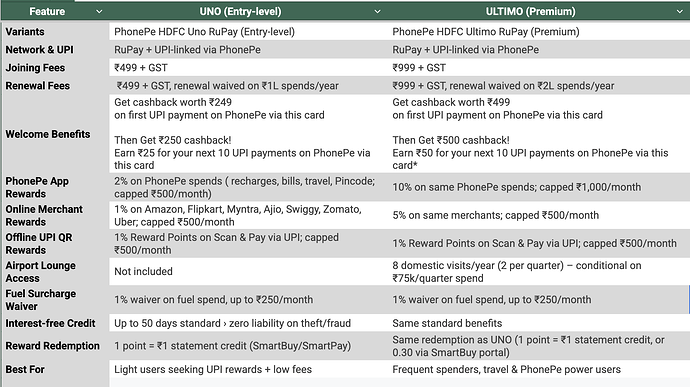

I’ve done a quick comparison of both the PhonePe-HDFC credit cards - Ultimo vs Uno you can check:

Please make sure to check the complete details here before choosing and applying for the any card as there are a lot of terms and conditions:

- PhonePe-HDFC Ultimo Credit card details /Terms and conditions - PhonePe Credit Card: Apply for PhonePe Ultimo Credit Card | HDFC Bank

- PhonePe-HDFC Uno Credit Card details / Terms and Conditions - Apply for PhonePe Uno Credit Card Instantly Online | HDFC Bank

And the process of applying for both the cards is very simple:

You can apply directly via the PhonePe app. Enter your details and then it will ask to complete the KYC with HDFC Bank. Once the card is issued, you can instantly link the card to UPI in the PhonePe app and start using it.

I also heard about these cards, and the information is helpful, but I have a small doubt about it. Do any of these cards, Ultimo or UNO, have international airport Lounge access?

Can anyone tell me something about the Forex Markup Percentage of these cards?

That hasn’t been officially detailed by the bank yet.

No,They both don’t offer any International Lounge access.Although in Phonepe’s press release, ‘Ultimo’ offers Two Domestic Lounge access per quarter(req. min 75000/- spent per quarter)