My mother, aged 65, has a lump sum and wants a safe monthly income. We are comparing LIC’s Jeevan Shanti with the government’s pension plan from the Post Office. Which one will give her a higher monthly payout?

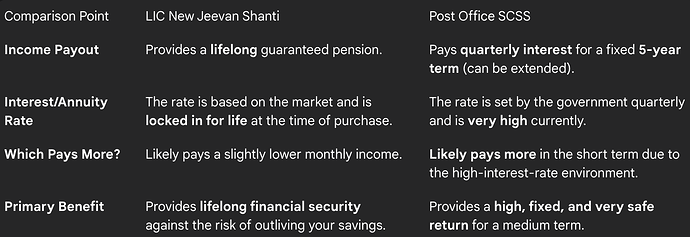

The choice between LIC Jeevan Shanti and the government’s best alternative, the Post Office Senior Citizen Savings Scheme (SCSS), depends on your primary goal. For the highest possible income in the short term, the SCSS is likely to pay more. For a guaranteed income that lasts for your entire life, LIC Jeevan Shanti is the better choice, even if the initial payout is slightly lower.

Clarifying the Available Government Schemes

My friend was looking for the government’s PMVYY pension plan for his retired mother. I had to explain that the Pradhan Mantri Vaya Vandana Yojana (PMVVY) was a limited-period scheme that closed for new investors in 2023. As of 2025, the best government-backed option for a senior citizen seeking a high, regular income is the Post Office Senior Citizen Savings Scheme (SCSS).

The High-Return Option for a Fixed Term: SCSS

I explained to my friend that the SCSS currently offers a very high and attractive interest rate, which is around 8.2% per annum. This interest is paid out every quarter. For someone whose main priority is getting the highest possible guaranteed payout over the next five years, the SCSS is almost certainly the winner. However, it is a 5-year deposit plan, not a lifelong pension.

The Lifelong Security Option: LIC Jeevan Shanti

In contrast, LIC Jeevan Shanti is a true annuity plan that provides a guaranteed income for the rest of the beneficiary’s life. A financial advisor explained that while the current annuity rate for a 65-year-old in Jeevan Shanti might be slightly lower than the SCSS interest rate (perhaps around 7.5%), that rate is locked in forever. It provides a permanent solution against the risk of outliving one’s savings, a security which the 5-year SCSS does not offer.

The Verdict: Higher Short-Term Payout vs. Lifelong Security

We concluded that the “better” plan depends on the specific need. If the priority is the absolute highest payout for the next five years, the SCSS is the clear choice. If the priority is a slightly lower but guaranteed and predictable income for life, no matter how long one lives, then LIC Jeevan Shanti is the safer and more appropriate long-term product.