I just bought a health insurance policy for my parents, who are both over 60. The total premium was ₹65,000 for the year. My colleagues are talking about tax benefits under Section 80D. How does this work for senior citizen parents? How much can I actually claim as a deduction?

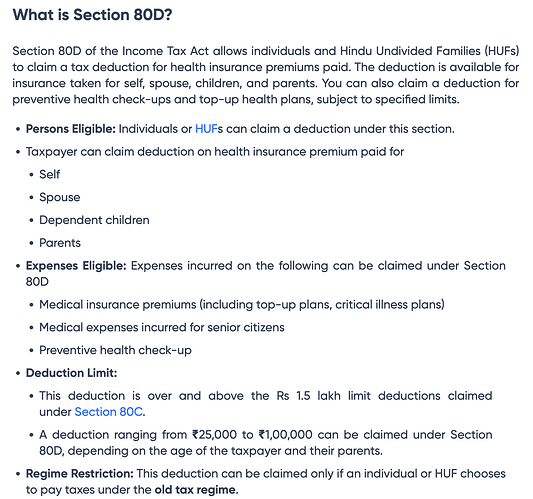

Section 80D of the Income Tax Act provides a significant tax benefit for individuals who pay health insurance premiums for their senior citizen parents. You can claim an additional deduction of up to ₹50,000 for the premium paid for parents aged 60 and above, over and above the limit available for your own family’s policy.

credits : https://cleartax.in/s/medical-insurance

Benefit 1: Up to ₹50,000 Deduction for Parents’ Premium

A friend of mine pays a ₹45,000 premium for his own family’s health insurance and a separate ₹60,000 for his senior citizen parents’ policy. When filing his taxes, he was able to claim ₹25,000 for his own policy (the maximum in that category) and an additional ₹50,000 for his parents’ policy. Even though he paid ₹60,000 for his parents, the deduction for them was capped at the ₹50,000 limit specified for senior citizens.

Benefit 2: Deduction on Medical Bills for Uninsured Parents

My colleague’s father is 78 and, due to his advanced age and health conditions, doesn’t have any health insurance. Under a special provision in Section 80D, my colleague is still able to claim a tax deduction. He diligently keeps all the bills for his father’s doctor visits, medicines, and diagnostic tests. Last year, these expenses totaled around ₹40,000, and he was able to claim that entire amount as a deduction under the ₹50,000 limit for uninsured senior parents.

Benefit 3: Total Combined Deduction with Your Own Policy

One of the best parts of Section 80D is that the deduction for your parents is in addition to the one for yourself. For example, I pay ₹20,000 for my own family policy and ₹40,000 for my parents’ policy (via net banking, of course). I can claim ₹20,000 (under my ₹25k limit) plus the full ₹40,000 for my parents (under their ₹50k limit), for a total deduction of ₹60,000. This combined benefit significantly reduces my taxable income.