I am confused between investing in a ULIP and a mutual fund in 2025. After considering all the charges, which one actually gives better returns?

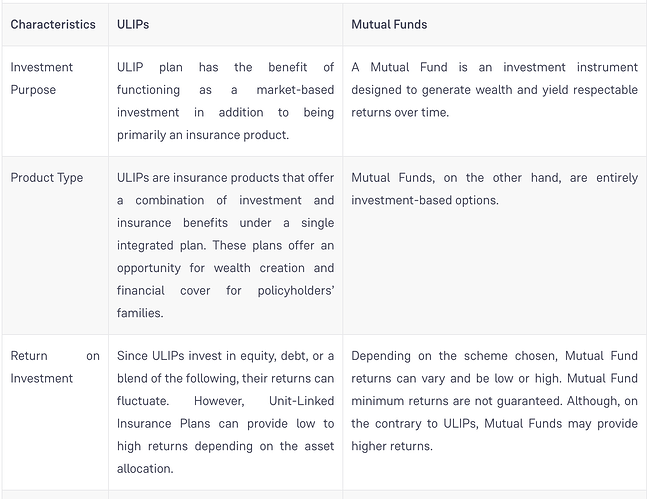

When choosing between a ULIP (Unit Linked Insurance Plan) and a mutual fund, the most common concern in 2025 is the real return after charges. ULIPs combine insurance with investment but involve policy administration costs, mortality charges, and fund management fees. Mutual funds, on the other hand, are purely investment-focused but still have expense ratios. Comparing the two helps investors understand which option maximizes net returns.

ULIP vs Mutual Fund in 2025

Comparing ULIP Returns After Charges in 2025

My colleague invested in a ULIP for five years and noticed that a portion of his premium went towards insurance charges before being invested. In the initial years, this reduced his overall returns. Over the long term, the impact of charges became lower, but his returns were still slightly below what a mutual fund would have generated with the same amount.

Comparing Mutual Fund Returns After Charges in 2025

A friend invested the same amount in a mutual fund through SIP. The only deduction was the expense ratio, which was much lower than ULIP charges. Over the same period, the mutual fund gave higher net returns because there were no insurance-related costs cutting into the investment.

Flexibility of ULIP vs Mutual Fund in 2025 : Liquidity and Exit Options

I found it difficult to exit the ULIP early because of the lock-in period of five years. On the other hand, the friend with mutual funds had the option to redeem units whenever required, making it more liquid and flexible. This difference influenced their perception of returns since mutual funds allowed better control over investments.