Posted in r/IndiaInvestments

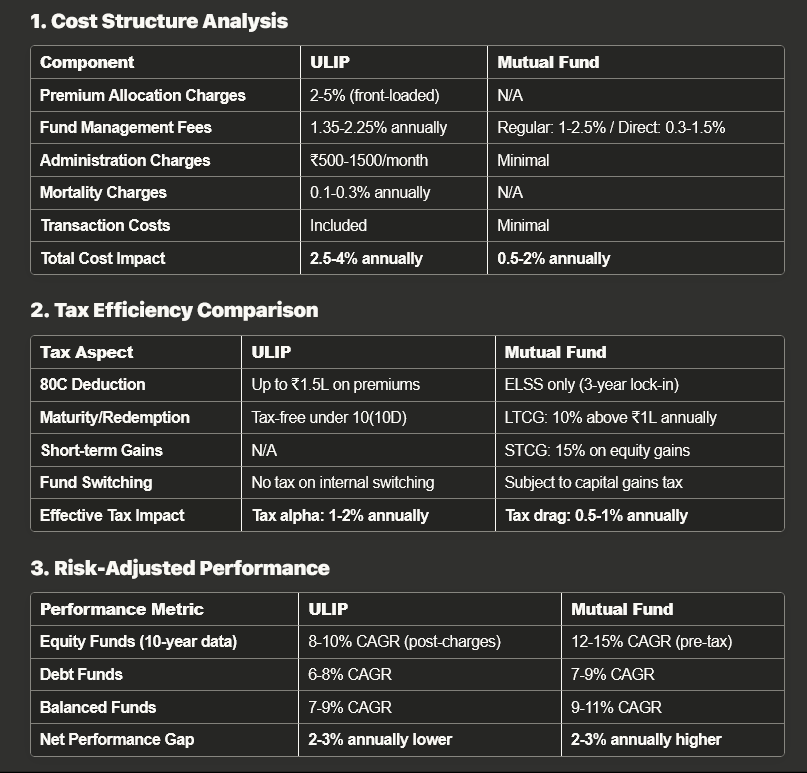

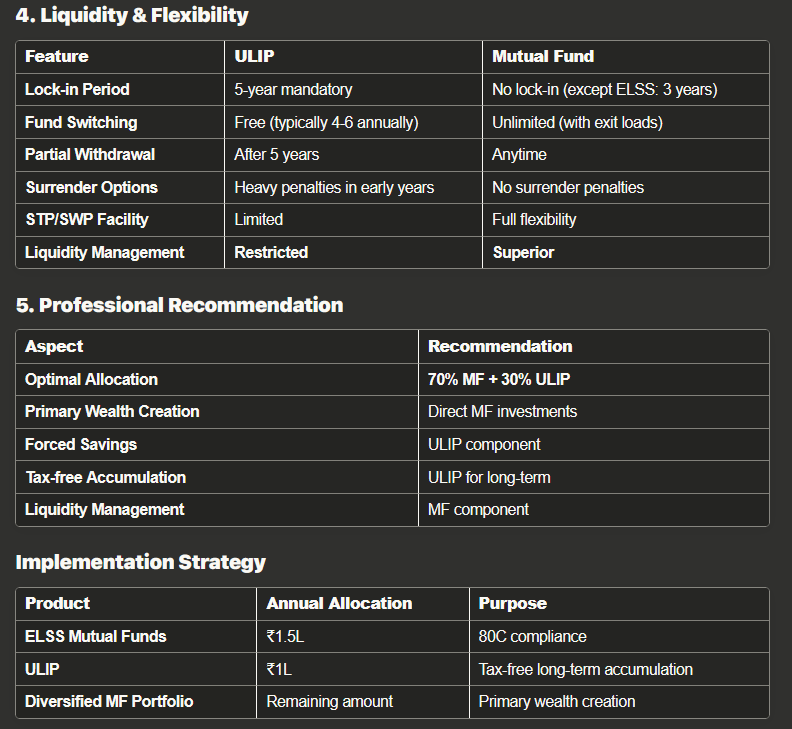

I’m currently restructuring my investment portfolio and need to make an informed decision between ULIPs and direct mutual fund investments. I’ve been researching both options extensively, but I’d like perspectives from professionals who have worked with both products.

Context:

- 32M, senior manager at consulting firm

- Annual income: ₹18L

- Investment horizon: 15-20 years

- Risk tolerance: Moderate to aggressive

- Current portfolio: Mix of equity MFs, PPF, and some direct stocks

Looking for data-driven analysis rather than generic advice. Would appreciate insights from those who’ve done detailed comparative analysis or have professional experience with both products.