I’ve just registered for PayZapp and I see a banner asking me to complete my KYC. I’m a bit busy and might not do it right away. What features will I be missing out on if I don’t complete it?

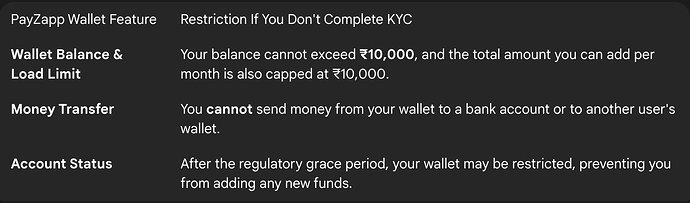

If you don’t complete your full KYC on PayZapp, your account operates as a “Minimum KYC” wallet. This type of account comes with significant restrictions on your balance, spending, and ability to transfer money, as mandated by the Reserve Bank of India (RBI) for all digital wallets.

The Strict Limits on Your PayZapp Wallet Without Full KYC

My cousin started using PayZapp but skipped the KYC process initially. He had about ₹3,000 in his wallet and then tried to add another ₹8,000 to pay for a new phone. The transaction was blocked. I had to explain that without full KYC, his wallet has a strict maximum balance limit of ₹10,000. He cannot hold more than that amount at any given time, and his monthly load limit is also capped at ₹10,000.

Why You Cannot Transfer Money Without Completing PayZapp KYC

My friend had some money in his minimum KYC wallet and wanted to send it to my bank account to settle a bill. He searched all over the app but couldn’t find the ‘Send to Bank Account’ or ‘Wallet to Wallet’ transfer option. These features are considered high-risk and are enabled only after a user has completed their Full KYC verification.

The Risk of Your PayZapp Account Being Suspended

A colleague had been using a minimum KYC wallet for a very long time, just for occasional small recharges. One day he found he couldn’t add any money to it. He discovered that the regulatory grace period to upgrade his wallet to Full KYC had expired. As a result, his account was placed in a restricted state where he could only spend his existing balance but was blocked from loading any new funds.