I know the duty rates for raw gold, but is the customs duty on finished gold ornaments, like necklaces and rings, different? What is the rate today?

The customs duty rate on gold ornaments in India is the same as the rate for raw gold. The total tax is a combination of the main import duties and a final GST charge. The key difference in the rules for ornaments is that they are eligible for a duty-free passenger allowance, unlike gold coins or bars.

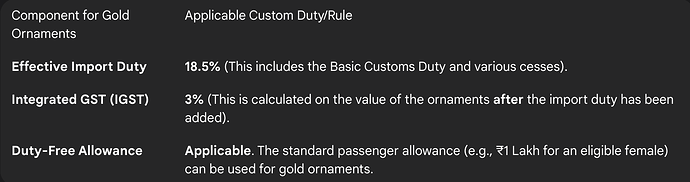

The Main Import Duty on Gold Ornaments

I was discussing this with my friend who is a jeweller, and he confirmed that the government does not differentiate between raw gold and finished ornaments when it comes to the tax rate. As of today, September 21, 2025, the effective import duty, which includes the Basic Customs Duty and various cesses, is 18.5% of the assessed value of the ornaments.

How GST is Applied to Imported Ornaments

My cousin was calculating the total cost of bringing in a gold necklace. After we factored in the 18.5% import duty, I reminded him about the final tax component. A 3% Integrated Goods and Services Tax (IGST) is also charged. It’s important to remember that this is applied to the value of the ornament after the 18.5% duty has already been added.

The Duty-Free Allowance for different Ornaments

My jeweller friend pointed out the one significant difference in the rules. The duty-free allowance (for example, ₹1,00,000 for an eligible female passenger) is only applicable to gold ornaments. This tax-free benefit does not apply to gold in the form of coins or bars. So, while the overall tax rate is the same, you can bring a small value of ornaments into the country completely tax-free.