I recently heard about ICICI Wealth Family Banking and want to know if I am eligible. What are the requirements, and how can I qualify for this premium service?

ICICI Wealth Family Banking is designed for high-net-worth individuals seeking personalized banking solutions, exclusive privileges, and wealth management services. While the benefits are attractive, eligibility is strictly defined, and understanding these criteria is essential before applying.

What Are the Basic Eligibility Criteria for ICICI Wealth Family Banking

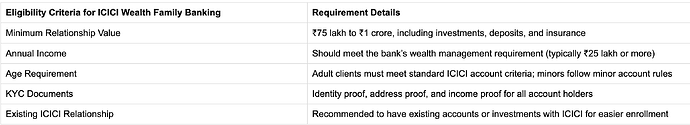

A client I advised recently wanted to join ICICI Wealth Family Banking. She learned that eligibility generally requires a minimum Relationship Value (RV) of ₹75 lakh to ₹1 crore, including investments, deposits, and insurance with ICICI Bank. Additionally, customers are expected to maintain a certain level of annual income to qualify for wealth management services. This scenario shows that having a substantial financial relationship with the bank is crucial for eligibility.

How ICICI Defines Relationship Value for Wealth Family Banking

Another customer, a businessman, was curious about how the bank calculates RV. He discovered that Relationship Value includes balances in savings accounts, fixed deposits, mutual funds, demat accounts, and certain insurance policies. The bank aggregates these holdings to determine if the customer meets the minimum threshold for Wealth Family Banking.

Are There Age or KYC Requirements for ICICI Wealth Family Banking

A family I know wanted to open a Wealth Family Banking account for multiple members. The bank requires standard KYC documentation for all primary and joint account holders. There is no strict age restriction for adult clients, but minors must meet ICICI’s account opening criteria for minor accounts, which may be linked to the primary Wealth Family Banking account.

How to Apply for ICICI Wealth Family Banking

One client approached her ICICI relationship manager to initiate the application. She was guided to submit her KYC documents, proof of income, and details of her existing relationship with the bank. The relationship manager then assessed her eligibility based on Relationship Value and income, after which the client received confirmation of her Wealth Family Banking enrollment.