I’m planning to open a PhonePe Wallet and wanted to know what the wallet limits are.

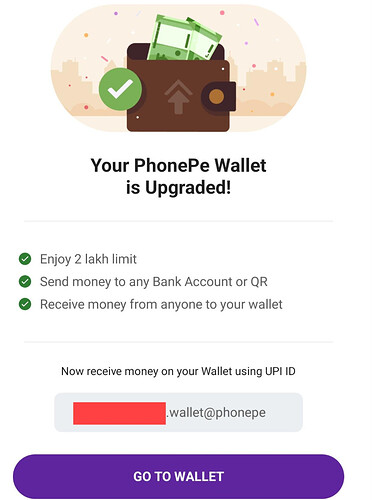

The PhonePe Wallet has usage limits based on your KYC status. For users with minimum KYC, the wallet has a ₹10,000 monthly top-up limit and a maximum balance cap of ₹10,000. Once you complete full KYC, these limits increase significantly, allowing you to load and maintain up to ₹2,00,000 in your wallet. Full KYC users can also withdraw money to their bank accounts, typically with a ₹5,000 per transaction and ₹25,000 daily limit, subject to an annual cap. Completing full KYC unlocks more features and higher transaction flexibility.

I use PhonePe regularly for payments, but I’m not sure about the wallet rules. Can anyone tell me what the wallet limit on PhonePe is and how much money I can actually keep or spend from it?

The PhonePe wallet does have certain limits set as per RBI guidelines. Here’s what you should know:

• Wallet Balance Limit: You can keep up to ₹10,000 at a time in your PhonePe wallet. This is the maximum balance allowed for most prepaid wallets.

• Monthly Add Money Limit: You can load a maximum of ₹10,000 in a month into your wallet.

• Spending/Usage: You can use the wallet balance for mobile/DTH recharges, bill payments, shopping, and payments at local stores that accept PhonePe.

• KYC Advantage: If you complete full KYC with PhonePe, you get more flexibility. For example, the annual wallet balance limit goes up to ₹1,20,000, and you can also transfer money back to your bank account.

So, in short, without KYC the limit is fairly low, but with KYC you get higher limits and more freedom to use your PhonePe wallet balance.