A friend of mine who recently bought a ULIP was confused about how it would be taxed, both during the investment period and at maturity. He asked me if ULIPs are fully tax-free or if there are certain conditions. To clear the doubt, I spoke with a colleague who already invests in ULIPs and also checked some reliable discussions on finance forums.

ULIP (Unit Linked Insurance Plan) is a unique product that combines life insurance with investment. While it provides tax-saving opportunities, the actual taxability depends on factors like premium amount, policy term, and when the policy was issued. Many investors are often unaware of the conditions, which can affect the overall benefit they get.

Tax Benefits on Premiums Paid for ULIP

One of my colleagues shared that the premiums he pays for his ULIP are eligible for tax deductions under Section 80C of the Income Tax Act, up to ₹1.5 lakh per year. However, he also pointed out that for policies issued after April 1, 2012, the deduction is only available if the annual premium is less than 10% of the sum assured.

Taxation on ULIP Maturity Proceeds for ULIP

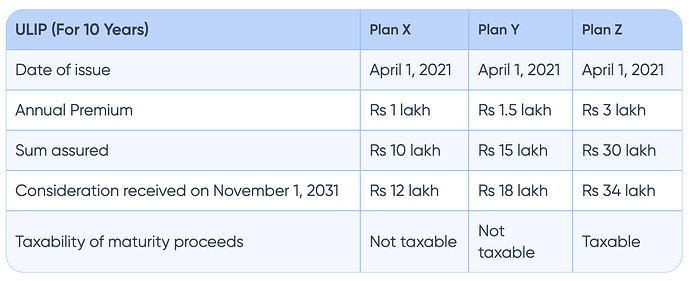

A friend who recently completed his ULIP term explained that his maturity proceeds were completely tax-free under Section 10(10D). But he highlighted an important detail: for policies issued after February 1, 2021, if the annual premium exceeds ₹2.5 lakh, the returns are taxable like capital gains. This was something he learned only after reading an online forum discussion.

credits : https://cleartax.in/s/unit-linked-insurance-plan-taxation-rules

Tax Treatment on Partial Withdrawals for ULIP

On a finance forum, an investor mentioned that partial withdrawals from his ULIP after the lock-in period of five years were tax-free, as long as the policy met the eligibility criteria under Section 10(10D). He found this flexibility useful for handling sudden financial needs without tax worries.

Taxation in Case of Death Benefit for ULIP

Another colleague pointed out that in case of the policyholder’s death, the payout to the nominee is fully exempt from tax. This makes ULIP a secure product for those who want to ensure their family’s financial safety without tax complications.