I’m looking at the claim settlement ratios for LIC and HDFC Life. Can you tell me which company has the higher ratio according to the latest official data?

According to the latest official data released by the insurance regulator, IRDAI, HDFC Life has a slightly higher claim settlement ratio than LIC. However, it is very important to note that the ratios for both companies are exceptionally high, placing them both in the top tier of the industry for reliability.

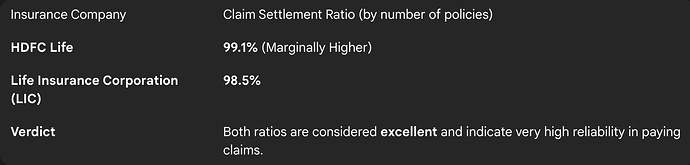

The Latest Official Claim Settlement Ratios

I was looking this up with my financial advisor from the most recent IRDAI annual report, which covers the financial year 2023-24. The official data in the report showed that HDFC Life had settled 99.1% of the individual death claims it received during that year. For the same period, the Life Insurance Corporation of India (LIC) had settled 98.5% of its individual death claims.

The Verdict: HDFC Life is Marginally Higher

Based purely on these official figures, my advisor confirmed that HDFC Life has the higher claim settlement ratio of the two for that year. This metric indicates that they paid out a slightly larger percentage of the total number of claims that were made to them.

Putting the Numbers in Context

My advisor also provided some crucial context to these numbers. He pointed out that while HDFC Life’s percentage is marginally higher, the total volume of claims handled by LIC is many times larger than any private insurer in the country. He concluded that both ratios, being well above 98%, are considered excellent and demonstrate a very strong track record of paying claims. For a policyholder, both companies are considered extremely reliable.