I want to start buying MMTC-PAMP digital gold. I have the SBI YONO app and also use Paytm and PhonePe. Is there any advantage or difference in buying through the bank app versus the payment apps?

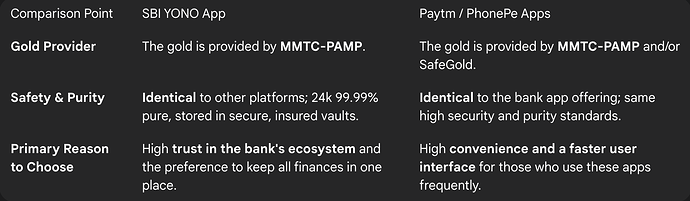

The underlying digital gold product you buy is exactly the same, regardless of whether you purchase it through the SBI YONO app, Paytm, or PhonePe. The “better” platform is not a matter of the gold’s quality or safety, but a personal choice based on which app you trust more and find more convenient.

The Common Product Behind All Three Apps

My father, who is a lifelong SBI customer, was convinced that buying gold through the YONO app must be safer. I had to explain to him that the digital gold on YONO is actually provided, stored, and insured by MMTC-PAMP. Similarly, the gold available on Paytm and PhonePe is also from the same providers. It’s the same 24-carat, physically vaulted gold, simply sold through different digital channels.

The Case for Buying Through the SBI YONO App

My father ultimately chose to continue using the YONO app for his purchases. For him, the deciding factor was his immense trust in the State Bank of India as a government-backed institution. He feels more secure keeping his gold investment within his primary banking application, which he already uses for all his other financial activities.

The Case for Buying Through Paytm or PhonePe

In contrast, I personally prefer using Paytm for my digital gold investments. I use the app multiple times a day for various payments, and I find its user interface to be faster and more convenient for making a quick gold purchase. Since I am confident that the gold’s safety is identical across all platforms, I choose the one that offers the smoothest and quickest user experience.