I have a lump sum to invest for 5 years and my absolute top priority is the safety of my money. Which is a safer instrument: an LIC endowment plan or a fixed deposit (FD) in a nationalized bank like SBI?

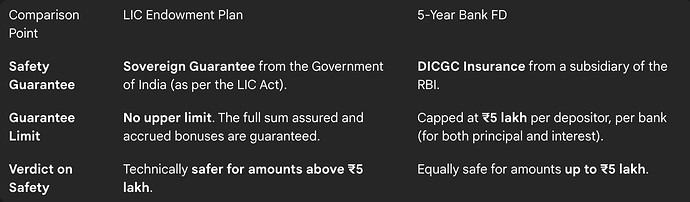

Both LIC endowment plans and bank fixed deposits are considered to be among the safest investment options available in India, and both are backed by government assurances. However, the nature of their safety guarantee is different, which makes an LIC plan technically safer for amounts that are significantly larger than ₹5 lakh.

The Safety Guarantee of a Bank Fixed Deposit

I was discussing this with my father, who is a very conservative investor and prefers bank FDs. I explained that when he invests his money in a bank FD, his deposit is insured by the Deposit Insurance and Credit Guarantee Corporation (DICGC) , which is a subsidiary of the RBI. This provides a very strong guarantee, but it is limited. The DICGC insures both the principal and interest amount up to a maximum of ₹5 lakh per person, per bank.

The Sovereign Guarantee of an LIC Endowment Plan

My financial advisor then explained the safety net for an LIC plan. He pointed out that under Section 37 of the LIC Act, 1956, all sums assured and bonuses declared by LIC are backed by a sovereign guarantee from the Central Government of India. This government guarantee has no upper limit; it covers the entire maturity or death benefit amount, no matter how large.

The Verdict on Which is Safer

My advisor’s final conclusion was that the “safer” option depends on the investment amount. For any amount up to ₹5 lakh, both are effectively equal in their high level of safety. However, for an investment above ₹5 lakh, the LIC plan is technically safer due to its unlimited sovereign guarantee. He gave an example: if you have ₹20 lakh in a single bank FD and that bank fails, you are only guaranteed to receive ₹5 lakh. If you have an LIC policy that matures for ₹20 lakh, the entire amount is guaranteed by the Government of India.