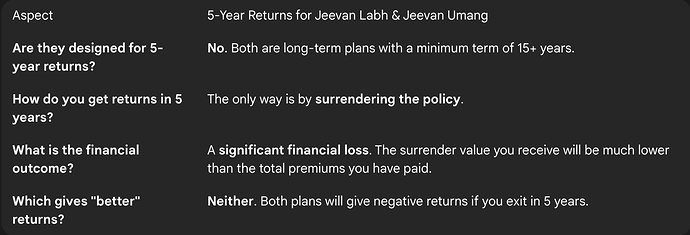

I am looking for a savings plan for about 5 years. Between LIC’s Jeevan Labh and Jeevan Umang, which one will give me better returns if I want to exit after 5 years?

Neither Jeevan Labh nor Jeevan Umang is designed to provide returns in a short period like 5 years. Both are long-term savings and insurance plans. If you exit either policy after just 5 years by surrendering it, you will get a significant financial loss, as the surrender value will be much lower than the total premiums you have paid.

The Nature of Long-Term Endowment Plans

I was discussing this specific question with a financial advisor. He was very clear that plans like Jeevan Labh and Jeevan Umang are structured as long-term commitments, with policy terms typically ranging from 15 to 30 years. They are not like a 5-year Fixed Deposit. Their financial benefits are designed to be realized only if the policy is held until its maturity.

The Financial Loss of Surrendering in 5 Years

My friend had considered surrendering his Jeevan Labh policy after paying premiums for 5 years. The advisor showed him a sample calculation. My friend had paid a total of ₹2,50,000 in premiums over the 5 years. The surrender value offered by LIC at that point was only around ₹1,80,000. This meant he would face a direct loss of ₹70,000. The situation would be almost identical for a Jeevan Umang policy.

Why the Returns are Negative in the Short Term

The advisor explained the reason for this loss. In the initial years of any traditional insurance policy, a large portion of the premium you pay goes towards the agent’s commission and the charges for providing the life insurance cover. The investment component of the plan only starts to build up and generate meaningful returns after many years. This is why surrendering a policy early always results in a loss.

The Verdict: Neither Plan is Suitable for a 5-Year Goal

The clear conclusion from the discussion was that for a 5-year savings goal, neither Jeevan Labh nor Jeevan Umang is a suitable or “better” choice. Both would result in a loss. An instrument like a 5-year bank fixed deposit or a short-term debt mutual fund would be a much more appropriate and financially sound option for such a goal.