I was shocked to see that the taxes on imported gold are over 15%. Why does the Indian government charge such a high custom duty on gold compared to places like Dubai?

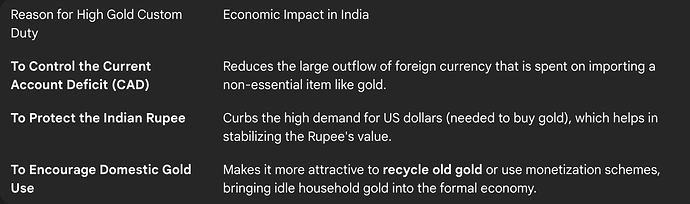

The high custom duty on gold in India is a deliberate economic policy, not just a way to generate revenue. The government uses it as a key tool to manage the country’s trade balance, protect the value of the Indian Rupee, and control the flow of foreign currency out of the country.

To Control the Current Account Deficit (CAD)

I was discussing this with a friend who works in finance. He explained that India is one of the world’s largest importers of gold, and these imports must be paid for in foreign currency, mainly US dollars. This massive outflow of foreign money widens the nation’s Current Account Deficit (the gap between imports and exports). By making imported gold more expensive through high duties, the government aims to reduce its overall demand, thus saving foreign exchange.

How High Gold Duty Helps Protect the Indian Rupee

My cousin asked how gold imports could affect the value of our currency. It comes down to supply and demand. To pay for imported gold, Indian buyers need to purchase US dollars. This high demand for dollars puts downward pressure on the Indian Rupee. My friend explained that by using high duties to curb the demand for imported gold, the government reduces the pressure on the Rupee, helping to keep its value more stable.

Encouraging the Use of Domestic Gold as a Policy

I read an interesting article that highlighted another strategic reason for the high duty. It is estimated that Indian households hold one of the largest private reserves of gold in the world, much of which sits idle in lockers. By making it very expensive to import new gold, the government indirectly encourages the recycling of old jewellery and participation in domestic gold monetization schemes, which helps bring this idle gold into the formal economy.