I’m trying to link my Axis Bank account through a financial app that uses Setu, but it keeps failing. Why does a problem with Setu make me lose trust in Axis Bank?

Anumati and Setu are both Account Aggregators (AAs), and they are also a part of a larger network. So, when you try to link your Axis Bank account through a financial app that uses a service like Setu, a trust issue can arise if the system is experiencing a downtime.

A Breakdown in the Secure Data Flow Between Setu and Axis Bank

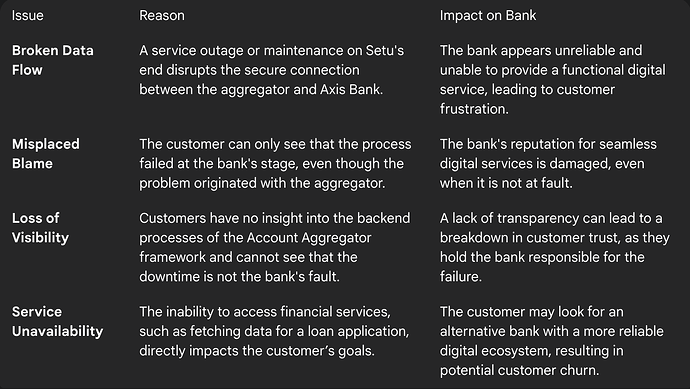

I was talking to a developer who works on the Account Aggregator framework, and he explained this in a great way. He said, “Think of it as a secure handshake.” When you initiate a request via an aggregator like Setu to access your Axis Bank data, a secure connection is established between the two. The bank verifies the request and sends the data back through that same secure pipe. If there is a downtime, say, for a system upgrade or a server issue on either side, that handshake breaks. The request is stuck in a digital limbo, which makes it feel like the bank isn’t cooperating. Because the customer can’t see the technical problem, they can lose confidence in the bank’s ability to provide reliable digital services.

Why the User Blames Axis Bank for Setu Downtime

I remember my friend trying to get a loan and the lender was using Setu to fetch his bank data. The application kept failing, and he was furious at Axis Bank. He thought the bank’s system was failing. The real issue was that Setu was undergoing scheduled maintenance and its service was temporarily unavailable. From the customer’s perspective, the process failed at the bank’s stage, even though the problem was with the aggregator. This kind of downtime creates a ripple effect of mistrust, even when the bank is not at fault. The customer is left frustrated with the bank because the service they are trying to access isn’t working.

How Setu Downtime Leads to Trust Issues with Axis Bank

Ultimately, the core problem is that the customer doesn’t have visibility into what’s happening behind the scenes. They only see that they can’t access a service they are trying to use for a particular bank. The downtime of an aggregator like Setu directly impacts the customer’s ability to use their own data, and because Axis Bank is the one holding that data, it takes the blame. This can damage the bank’s reputation for seamless digital services, even when the underlying technology is solid. The user feels their trust is misplaced because the digital promise of the account aggregator ecosystem is not being fulfilled, and they naturally hold the bank responsible for the failure.