![]() What do you think? Have you ever been denied a loan despite having a good score? Or got easy approval even with an average one? Let’s discuss!

What do you think? Have you ever been denied a loan despite having a good score? Or got easy approval even with an average one? Let’s discuss! ![]()

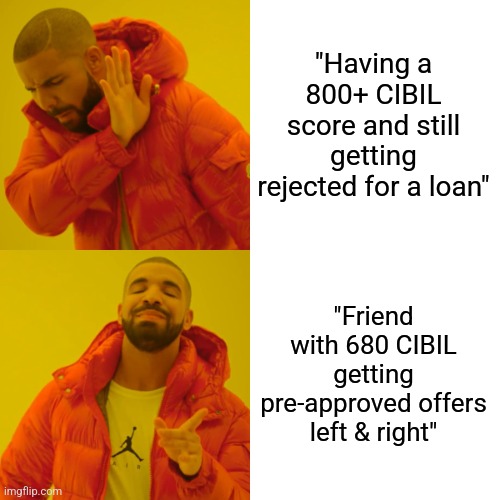

Imagine this: You walk into a bank, confident with your 800+ CIBIL score, expecting a smooth loan approval. But BAM! Rejected. Meanwhile, your friend with a 680 score waltzes out with a shiny new credit card. Unfair? Not really.

Here’s the reality: CIBIL score isn’t the only player in the game! ![]()

![]() Why does this happen?

Why does this happen?

- Banks check more than just your score. They also look at your Debt-to-Income Ratio (DTI), Fixed Obligation to Income Ratio (FOIR), and repayment capacity.

- Too many loans? High utilization? Even with a 750+ score, banks might see you as overleveraged.

- Good income, stable job, and low existing EMIs? Even with a lower score, banks may approve your application!

Jargon Breakdown: Why a Good Score Alone Won’t Cut It

- DTI (Debt-to-Income Ratio): If your monthly EMIs eat up a big chunk of your income, lenders hesitate.

- FOIR (Fixed Obligation to Income Ratio): If more than 50-60% of your income is locked in fixed obligations, red flags go up!

- Credit Mix Matters: Having a blend of secured (home loans) and unsecured loans (credit cards, personal loans) builds trust.

Bottom Line?

A high CIBIL score is great, but not a free pass. Banks check multiple factors, and financial discipline matters just as much.

A good credit score serves as a helpful factor in bank loan decisions although it does not determine everything. Here’s why:

Banks will reject your loan application when your monthly EMIs surpass 40-50% of your income even though you have a CIBIL score above 750.

A high credit score that results from credit card payments without any history of loans may not be sufficient for lenders. Lenders tend to be cautious about approving loans because they prefer borrowers who have both secured home or car loans and unsecured credit cards and personal loans.

The application of multiple loans or credit cards within a brief timeframe creates a perception of “credit hunger” among lenders who view this behavior as a reason to deny your application even though your credit score is strong.

Different financial institutions establish their own standards for loan approvals with 750+ as excellent for one bank but 770+ as excellent for another bank when approving high-value loans. Your application can receive rejection from one lender but approval from another lender who reviews the same request.

Self-employed individuals and gig workers along with employees from startup companies with inconsistent cash flow face increased rejection possibilities regardless of their strong credit score.

On the Flip Side: Easy Approval Despite an Average Score (650-700)?

-

Banks tend to approve loan applications from existing customers who demonstrate solid banking relationships despite having slightly lower credit scores.

-

Salaried workers from major corporations including MNCs PSU and Govt. usually secure preferred loan approval terms.

-

A secured loan such as a home loan backed by property collateral will receive approval from lenders even with a score between 650 and 700.

The Takeaway:

A credit score serves as an important factor yet it does not determine the entire outcome of loan approvals. Before you submit your application you must verify your DTI ratio and recent credit behavior and specific lender requirements. ![]()

I’ve seen both sides of it. Some people with solid scores still get rejected because lenders also check income stability, job profile, or existing debt. On the other hand, I’ve known folks with average scores who got approvals since their income was strong or they had a good relationship with the bank. The score matters a lot, but it’s never the only factor.